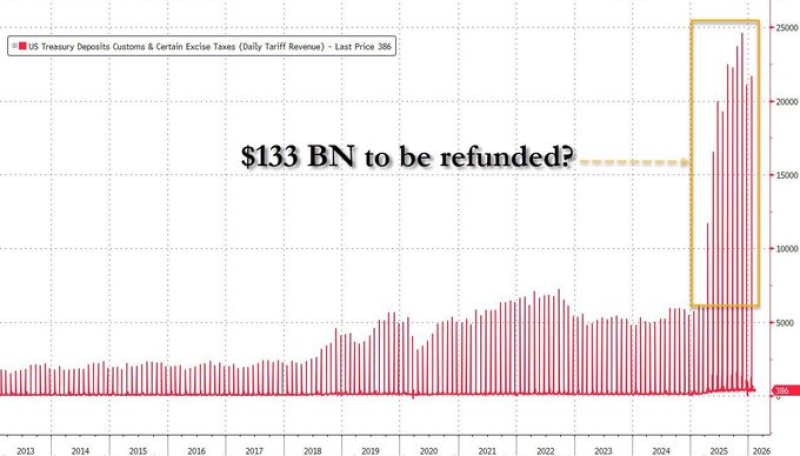

⬤ A dramatic surge in U.S. Treasury deposits and customs tariff revenues has put markets on edge, with some analysts pointing to the possibility of a $133 billion liquidity event in the near term. Daily tariff revenue data shows spikes that dwarf anything seen over the past decade, raising an obvious question: where does all that capital go next? When funds of this scale leave government accounts and re-enter private sector balance sheets, the effects on reserve levels and money market dynamics can be far from subtle. For broader context on how macro signals are shifting, the Gold/Silver Ratio offers a useful liquidity and trend indicator.

⬤ The sheer size of a potential $133 billion refund puts it in a league of its own. "Moving that magnitude of capital is not a normal day-to-day occurrence," as analysts covering the data have noted - and that framing matters. Large Treasury outflows can tighten or loosen reserve balances quickly, forcing banks and funding markets to adjust in real time. With reserves already running lean and funding markets sensitive to even modest liquidity swings, this kind of shift could test the Fed's capability to manage reserves without destabilizing short rates - something it has already had to navigate in recent months.

⬤ The ripple effects could extend well beyond overnight rates. Rapid fiscal flows of this size can influence bank liquidity buffers, affect how institutions price short-term funding, and create feedback loops across interest rate markets. This is happening at a moment when the Fed is already juggling rate policy, balance sheet normalization, and unpredictable fiscal inputs. Treasury yields dropping below 4% has added another layer of complexity to an already delicate macro picture.

⬤ The bottom line is straightforward: fiscal flows of this magnitude are not a side story - they are a core part of the liquidity backdrop that shapes financial conditions broadly. A $133 billion refund would demand a closer look at funding pressures, balance sheet strategy, and potential volatility in the weeks ahead.

Usman Salis

Usman Salis

Usman Salis

Usman Salis