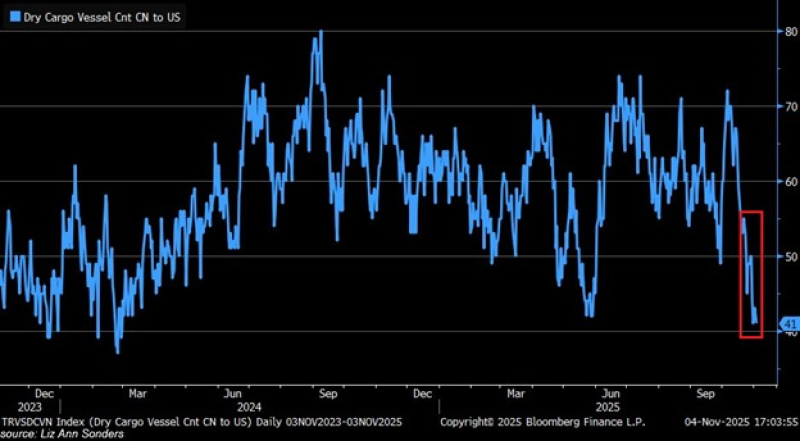

● Container shipping from China to the US is in freefall. The number of dry-cargo vessels en route to American ports has fallen to just 41—the lowest since February 2024. Bloomberg data confirms this collapse, showing vessel counts near the bottom of their two-year range. In just three weeks, large ship numbers dropped by 30 vessels (roughly 42%), well below the 18-month average of 60.

● This comes as policymakers consider new taxes on high-emission cargo fleets, including carbon surcharges and emissions-based port fees. Industry watchers warn these measures could push smaller shipping firms toward bankruptcy and drive experienced workers to less regulated markets. For a sector already struggling with collapsing volumes, extra tax pressure could make things worse.

● The Kobeissi Letter emphasizes the severity: total cargo throughput has been cut in half to around 300,000 TEUs—the lowest since at least January 2024. Combined volumes across major Asian exporters have also dropped sharply to about 700,000 TEUs, the weakest since February 2024. As he puts it, "US–China trade is rapidly slowing."

● The proposed tax hikes risk making a bad situation worse. Higher operating costs could mean fewer port jobs, weaker supply chains, and lower corporate tax revenues. With cargo volumes already tanking, aggressive taxation might deepen the downturn and slow any recovery.

● With shipping at multi-year lows and policy uncertainty growing, observers are wondering if this is just a temporary shock—or the beginning of a deeper shift in US-China economic ties.

Usman Salis

Usman Salis

Usman Salis

Usman Salis