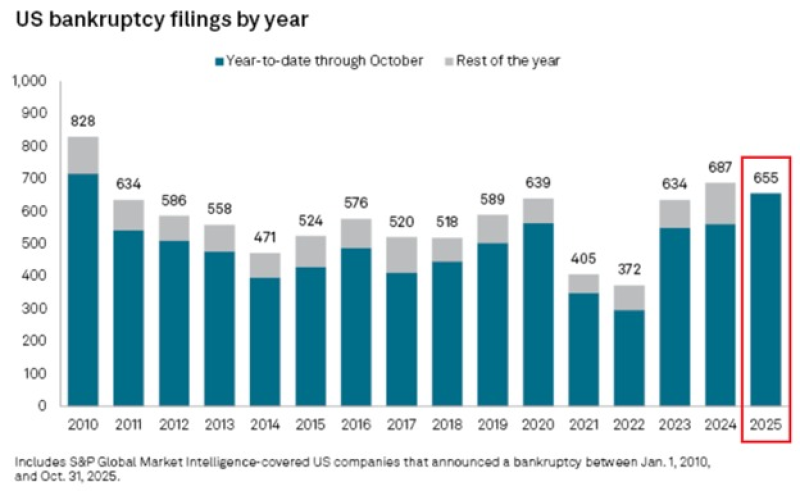

⬤ Corporate distress in America has intensified dramatically this year, with large-company bankruptcy filings hitting 655 by the end of October. This represents the highest year-to-date figure in 15 years and has already surpassed every annual total since 2011 except for 2024. The data shows a clear upward trend from the unusually low levels seen in 2021, with 2025 numbers approaching the elevated rates from the early 2010s. This sharp increase signals growing financial pressure across the corporate landscape as lending conditions become tighter.

⬤ The recent three-month period tells an even more concerning story. October saw 68 companies file for bankruptcy, following 66 in September and 76 in August, making this the most severe three-month stretch in at least six years. Bankruptcies have nearly doubled since 2022, driven by rising interest costs, weaker demand, and heavier refinancing obligations. When broken down by sector, industrials lead with 98 filings this year, followed by consumer discretionary at 80 and healthcare with 45.

⬤ The long-term trend reveals how dramatically the situation has changed. The current surge stands in stark contrast to the relatively stable bankruptcy environment between 2015 and 2019, and especially the sharp drop during 2021. The steep rebound since then has been both rapid and persistent, pointing to a fundamental shift as more companies face liquidity problems and shrinking access to capital. The rising number of large-company filings highlights a growing disconnect between positive headline economic data and the real financial challenges many leveraged or cyclical businesses are facing.

⬤ This wave of corporate bankruptcies matters beyond just the numbers. It reflects mounting stress in major sectors of the economy and can ripple out to affect jobs, business investment, and overall credit market confidence. The continued upward trajectory raises questions about how sustainable the economic momentum will be heading into next year.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi