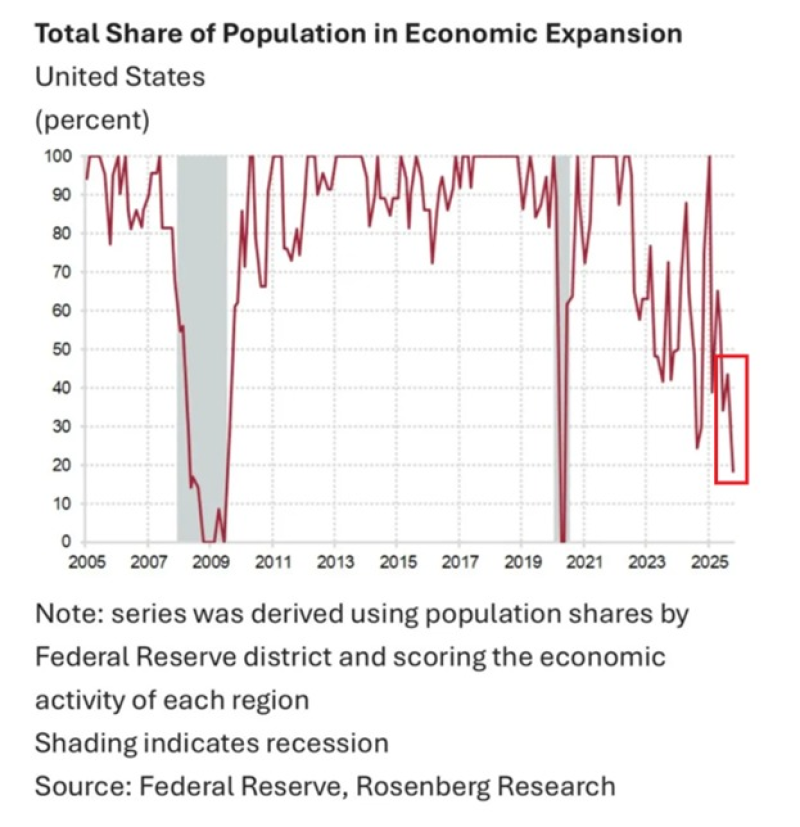

● Roughly 82% of the U.S. population now lives in regions experiencing recession, matching levels last seen in 2020. Data from the Federal Reserve's Beige Book, compiled by Rosenberg Research, shows the share of Americans in expanding regions has dropped sharply since early 2025—echoing patterns from the 2008 financial crisis and COVID-19.

● This regional contraction is already influencing policy debates. Economists worry that growing gaps between Federal Reserve districts could trigger local bankruptcies, reduced investment, and migration to stronger states. Some experts propose temporary regional tax relief or targeted corporate support to protect jobs, though such measures risk disrupting federal budgets without matching revenue adjustments.

● Analysts warn that sustained regional downturns will erode tax revenues and consumer incomes, weakening federal finances. Industry voices suggest offsetting losses through higher profit taxes on strong-performing corporations, using those funds to stabilize struggling state economies—potentially preserving fiscal health without expanding deficits or stifling innovation.

● The data reveals a widening gap between national metrics and local realities. While the Atlanta Fed projects 3.9% GDP growth for Q3 2025, most Americans face slower job growth, falling demand, and industrial stagnation. This uneven expansion could reduce income tax revenues and deepen state-level inequality.

● As TheKobeissiLetter noted, "Currently, ~82% of the US population lives in regions experiencing an economic recession, the highest share since 2020." The finding captures America's economic paradox in 2025: strong headline numbers masking widespread local struggle.

Usman Salis

Usman Salis

Usman Salis

Usman Salis