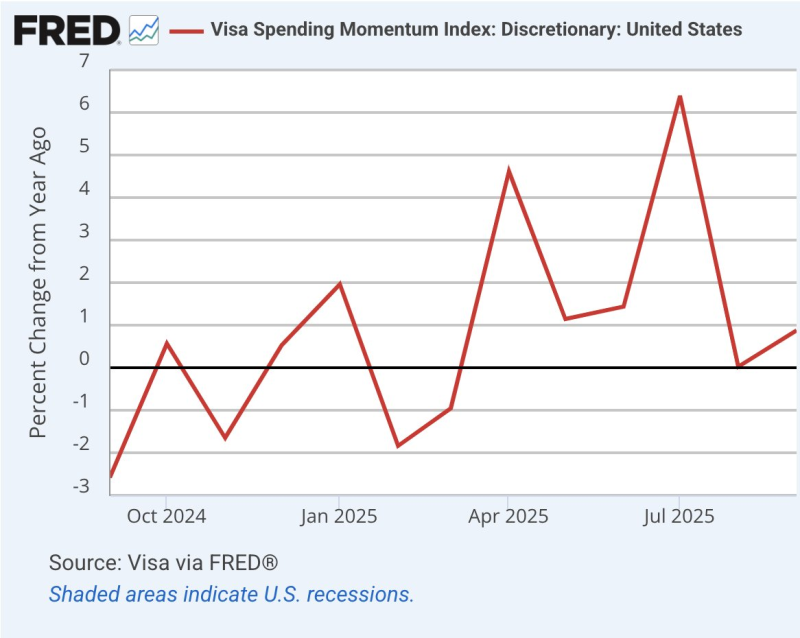

Recent data from the Visa Spending Momentum Index (VSMI) shows American consumers are back in spending mode. After months of fluctuation, the index has turned positive in early October, suggesting households are ready to open their wallets for the holiday season.

Key Observations

As highlighted bySeth Golden, the October 2025 chart reveals a notable rebound after a volatile year. The index dipped below zero several times through late 2024 and early 2025, with strong peaks appearing in April and July 2025. The latest October surge aligns with the start of holiday shopping and reflects renewed consumer confidence despite ongoing inflation concerns.

What's Behind the Recovery?

The rebound stems from a mix of seasonal patterns and economic fundamentals. October traditionally kicks off gift-buying and promotional activity, which lifts transaction volumes. A solid labor market continues to support household spending power, while expanded credit card usage is fueling discretionary purchases. Categories like travel, dining, and retail are holding up well, showing consumers still prioritize experiences and shopping.

Impact on Visa

Higher transaction volumes translate directly into stronger revenue for Visa (NYSE: V). The index serves as a forward-looking signal for the company's financial performance, and a robust Q4 could deliver meaningful earnings growth. The resilience in U.S. consumer demand positions Visa to benefit both at home and across its global payment infrastructure.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova