The U.S. Treasury Department is taking active steps to manage the country's growing debt burden while keeping the bond market stable. On October 28, 2025, it completed a $2 billion buyback of long-dated government bonds, part of an ongoing strategy to support liquidity in a market that's been showing signs of strain. With Treasury yields elevated and volatility lingering in longer maturities, this move signals the government's commitment to maintaining smooth market operations even as total federal debt tops $34 trillion.

Treasury Conducts $2 Billion Debt Buyback Amid Market Tightness

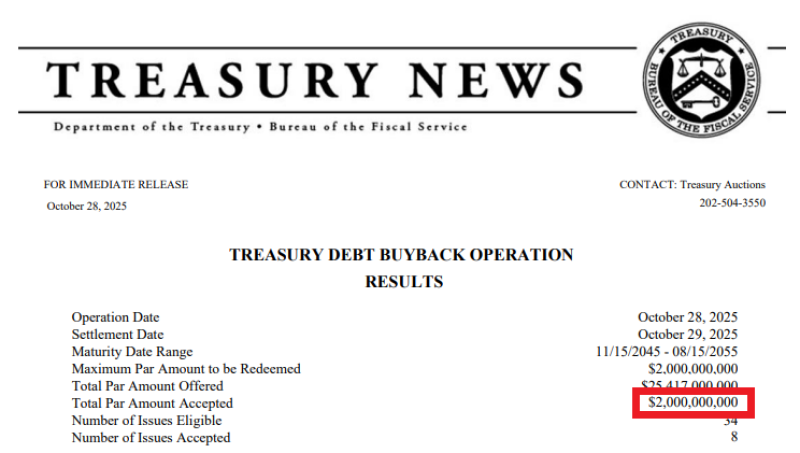

According to official documents from the Bureau of the Fiscal Service and first reported by Barchart, the Treasury repurchased $2 billion worth of bonds maturing between November 15, 2045, and August 15, 2055. Market participants submitted offers totaling $25.4 billion, but the Treasury stuck to its $2 billion cap, accepting the full amount it had allocated for this round. That high level of interest shows there's real demand from investors looking to unload older, less liquid bonds.

This marks one of the Treasury's larger buyback operations in recent months. The goal is straightforward: improve the functioning of the secondary market and make it easier to trade older debt that doesn't see as much activity as newer issues. By focusing on bonds in the 20- to 30-year range, the Treasury is addressing the most volatile segment of the market, where imbalances can quickly affect pricing and investor confidence.

Why the U.S. Is Buying Its Own Debt

The buyback program serves several key purposes:

- Enhancing liquidity for older, off-the-run Treasury issues that trade less frequently

- Reducing refinancing risk by repurchasing bonds ahead of maturity

- Supporting market stability amid sustained investor demand for newer issues

With federal debt now exceeding $34 trillion and annual interest costs surpassing $1 trillion, rising yields have made refinancing more expensive. By repurchasing bonds strategically, the Treasury aims to ease some of that pressure while keeping the market for U.S. government debt healthy. Treasuries remain the global benchmark for safe assets, so maintaining their liquidity and stability is a top priority for policymakers.

While $2 billion might seem modest compared to the scale of overall borrowing, it represents a more tactical approach to debt management. Rather than simply issuing new bonds to roll over old ones, the Treasury is actively reshaping its portfolio to reduce risk and improve market conditions.

Market Reaction and What Comes Next

Analysts viewed the buyback as a measured but meaningful step. With Treasury yields near multi-decade highs, the operation could help take some pressure off long-term rates while reassuring investors that the bond market remains functional and liquid. There's speculation now about whether the Treasury will expand these buybacks in future rounds, possibly including mid-duration maturities if conditions warrant it. How this first phase performs will likely guide the structure of upcoming operations through early 2026.

The Treasury's willingness to accept the full $2 billion also reflects confidence in its liquidity management strategy. Historically, buybacks have been used during periods of high issuance or when investor appetite for older bonds weakens. This round fits that pattern, coming at a time when the long end of the yield curve has been particularly volatile.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah