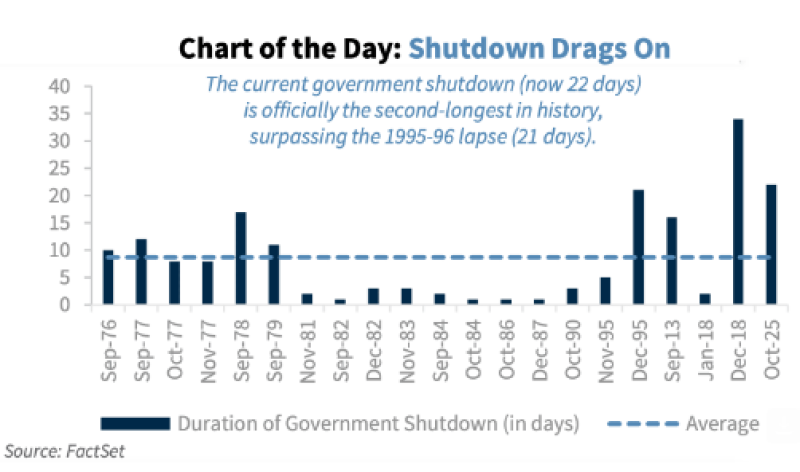

The U.S. government shutdown has hit a troubling milestone, marking 22 straight days without resolution — the second-longest closure the country has ever seen. This standoff has now outlasted the 1995–96 shutdown that went 21 days, trailing only the record-breaking 35-day lapse from 2018–19.

While shorter shutdowns were more typical in earlier decades, recent years have seen these political deadlocks drag on much longer. The trend points to deepening partisan divisions that keep paralyzing budget talks in Washington.

Economic and Political Fallout

Shutdowns happen when Congress can't agree on funding bills, forcing agencies to close their doors. According to data from FactSet highlighted by Barchart, this pattern has become increasingly disruptive. Essential services like national security and air traffic control keep running, but hundreds of thousands of federal workers end up furloughed or working without pay, which drags down consumer spending across the board.

Each week of shutdown can shave roughly 0.2 percentage points off quarterly GDP, experts say. Small businesses with government contracts lose income, public programs stall out, and investor confidence takes a hit — especially in sectors like defense and infrastructure that rely heavily on federal dollars. The current situation shows just how fragile budget negotiations have become, with lawmakers unable to find common ground even as economic uncertainty looms large. The longer this drags on, the more it threatens both public trust and financial stability.

Market Response and Historical Context

Stock markets usually bounce back from brief shutdowns, but extended ones create real problems by delaying key economic reports — inflation numbers, retail sales, employment data — which makes it harder for the Federal Reserve to make informed policy calls.

Looking at the historical data, the average shutdown lasts about 8 days, meaning we're now at nearly three times that length. The numbers also show that both how often and how long these shutdowns last have been climbing since the 1990s, revealing systemic gridlock in how the federal budget process works.

What's Ahead

If this stalemate continues, analysts warn that 2025 could set a new record for fiscal dysfunction. The next few days matter — pressure is building on lawmakers to cut a deal before the economic damage gets worse. This isn't just political theater anymore. It's a stark reminder of how these recurring budget crises chip away at government efficiency and shake public confidence in America's ability to manage its own economy.

Usman Salis

Usman Salis

Usman Salis

Usman Salis