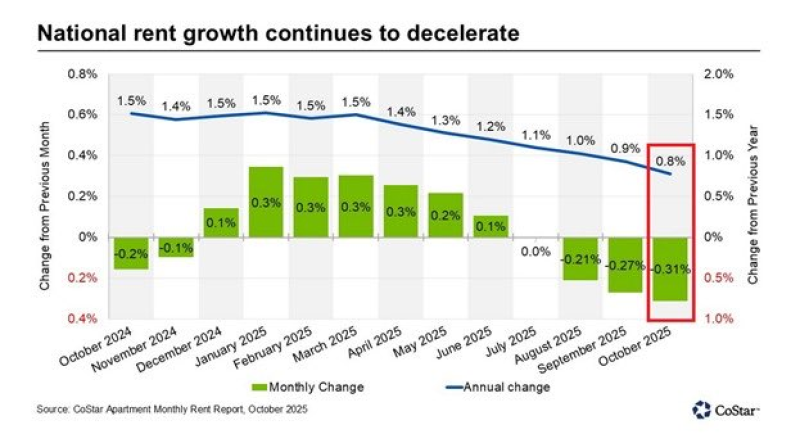

⬤ U.S. rent inflation weakened further in October, with monthly rent growth turning negative based on new data from CoStar. The shift into deflation is particularly significant because rent carries one of the heaviest weights in the CPI basket, giving it much greater impact on headline inflation than smaller categories like electricity. The chart shows rents declining 0.31 percent month over month, marking the sharpest negative reading of 2025 and extending the multi-month cooling trend.

⬤ The data also reveals a steady slowdown in the annual rate of rent growth, which has dropped from roughly 1.5 percent in late 2024 to just 0.8 percent in October 2025. Monthly changes earlier in the year hovered between 0.2 and 0.3 percent before turning negative in August, September, and October. The continued decline reflects softening demand conditions across the rental market, with the annual growth line showing consistent deceleration throughout 2025.

⬤ The deflationary pull from rents now outweighs inflation in categories that continue to rise but carry lower CPI weights. Even if items like electricity remain elevated, their effect on the overall index is limited compared with falling housing costs. The combination of negative monthly readings and weakening annual growth points to a meaningful shift in supply-demand dynamics in the rental market, with prices resetting following earlier periods of rapid growth.

⬤ This decline in rent inflation is important because it directly shapes headline CPI momentum and broader assessments of economic cooling. Persistent weakness in rents can affect household budgets, shift spending patterns, and ease inflationary pressure across the economy. With monthly rent readings now in deflation and annual growth steadily slowing, one of the most influential CPI components is firmly moving into a cooler phase, applying downward pressure to overall inflation in the months ahead.

Peter Smith

Peter Smith

Peter Smith

Peter Smith