⬤ The U.S. labor market is starting to look shaky. Monthly nonfarm payroll data, tracked alongside a 12-month moving average, is showing exactly the kind of sustained slowdown that has historically lined up with recessions. Here's the thing — if you're still focused on where inflation was six months ago, you might be missing what the jobs data is already telling us right now.

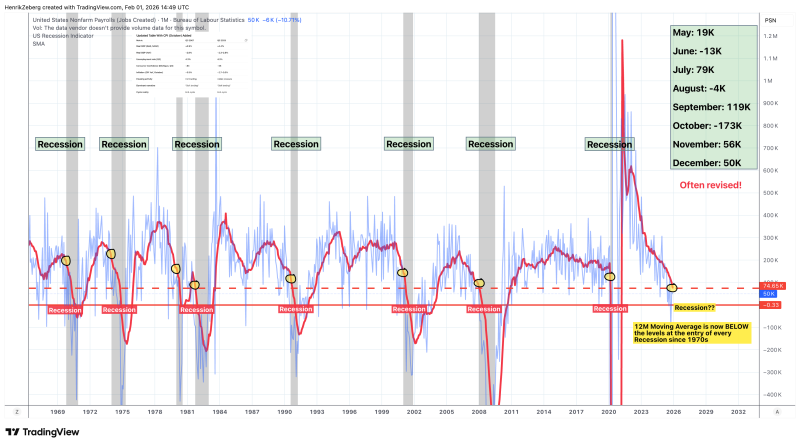

⬤ Recent monthly payroll numbers have been all over the place. We saw a 119K gain in September, but then a sharp -173K drop in October. Other months told a similar story of whiplash — 19K up in May, then -13K in June, 79K in July, then -4K in August. Payroll figures get revised constantly, and right now those short-term swings are doing a pretty good job of hiding the bigger problem underneath.

⬤ The real red flag is the 12-month moving average. It has now dropped below the level it was at before every single U.S. recession since the 1970s. That's not a prediction — it's just where things stand right now. The chart doesn't say a recession is coming, but it puts today's labor market squarely in historically vulnerable territory.

⬤ For markets, this matters more than it might seem. Job trends shape economic confidence, interest rate expectations, and how investors price risk. As the post-pandemic hiring surge fades, the real question is whether the economy has already worked through its inflation hangover — or whether weakening employment is the first sign of something bigger ahead.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova