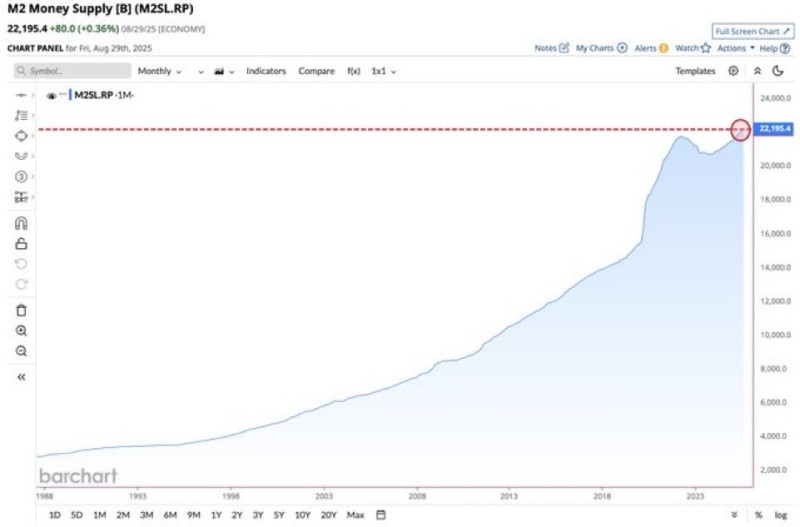

The U.S. money supply has climbed to an unprecedented $22.2 trillion, marking a significant milestone in the financial system's liquidity expansion. This development reflects both the economy's resilience and the delicate balancing act facing policymakers as they navigate between supporting growth and controlling inflation.

M2 Reaches All-Time High

According to Barchart trader data, M2 has returned to its long-term growth path after a period of turbulence. The money supply expanded dramatically during the 2020–2021 pandemic response, pulled back slightly as the Federal Reserve tightened policy in 2022–2023, and has now surged to fresh highs in 2025.

The pattern reveals three distinct phases: steady pre-pandemic growth from 1988 to 2019, an explosive spike during emergency stimulus programs, and a brief correction followed by the current rebound. This latest rise indicates liquidity is flooding back into the system, potentially providing tailwinds for equities, bonds, and digital assets.

What It Means for Markets

More money in circulation generally translates to more capital available for investment and consumption. This liquidity can lift asset prices across multiple sectors, boost consumer spending and short-term economic output, and create the risk of accelerating inflation if velocity picks up. The key question for policymakers is whether they can maintain stability without reigniting price pressures that were only recently brought under control.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov