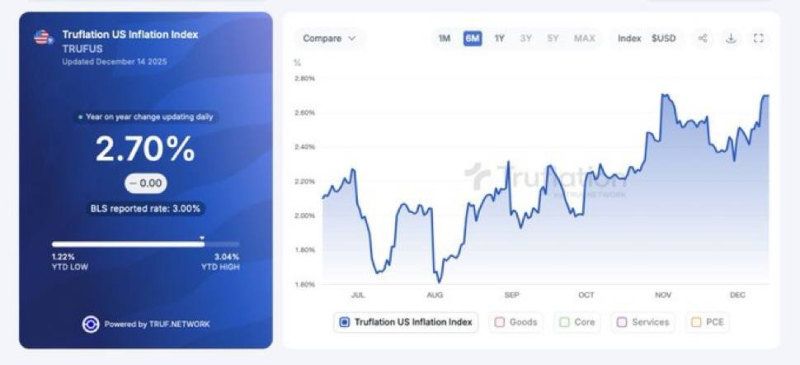

⬤ US inflation is starting to climb again, showing renewed price pressures that have markets rethinking when the Fed might ease up on rates. The chances of a January rate cut are now looking pretty slim. This shift comes after a period where cooling inflation had people optimistic about earlier policy relief.

⬤ The uptick in inflation numbers has forced markets to adjust their interest rate expectations. With lower odds of a cut happening soon, it looks like the Federal Reserve will stick with its current approach longer than many had hoped. The data shows inflation momentum turning back up, raising concerns that the path to stable prices might be bumpier than expected.

⬤ Historically, when inflation cools and rate cuts seem likely, risk appetite improves. But when inflation heats back up, markets get more cautious. With January cut odds fading, BTC has moved into wait-and-see mode as traders watch incoming data and Fed signals.

⬤ Why this matters: inflation trends directly shape what central banks do, which affects liquidity and how willing investors are to take risks. If inflation keeps rising, the Fed's easing cycle could get pushed back, potentially triggering more volatility across markets. Since Bitcoin trades heavily on macro conditions, these inflation swings and changing rate expectations will likely keep driving price action in the near term.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi