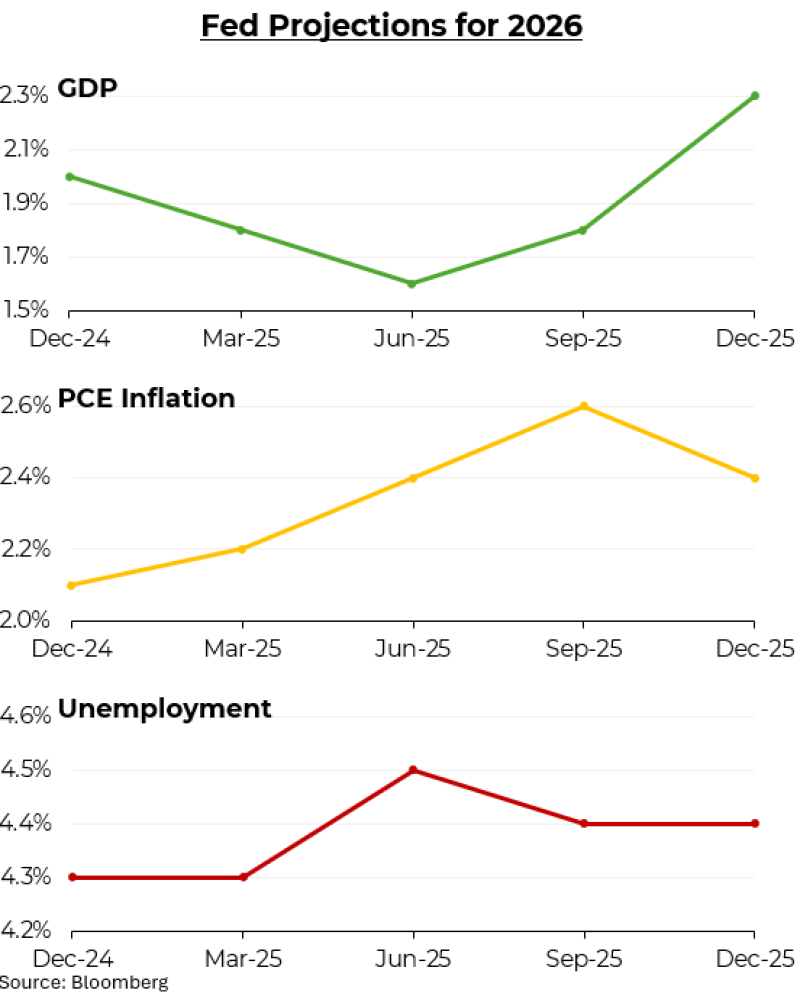

⬤ The Federal Reserve just bumped up its 2026 outlook, revising expectations across the board for economic growth, inflation, and jobs. The latest projections show both GDP and PCE inflation running hotter than previously thought, while unemployment is expected to edge higher. The numbers paint a picture of an economy navigating competing forces as it heads into next year.

⬤ GDP forecasts tell an interesting story through 2025. Growth dips to around 1.6% by mid-year before rebounding to approximately 2.3% by December. That upward swing comes from revised productivity assumptions that support stronger output going into 2026. PCE inflation follows a similar arc—starting near 2.1% at the end of 2024, peaking around 2.55% by September 2025, then pulling back slightly by year-end. The takeaway: inflation could stay stickier than hoped as productivity picks up steam.

⬤ The jobs picture shows some softening ahead. Unemployment holds steady around 4.3% early in 2025, climbs to roughly 4.5% by mid-year, and levels off from September through December. Here's the twist: GDP rises while unemployment also rises. Higher productivity can fuel economic growth without necessarily creating more jobs in the near term.

⬤ Why does this matter? These revised projections will influence how the Fed thinks about interest rates and the path forward. Stronger growth potential, elevated inflation readings, and a softer labor market create a tricky balancing act for policymakers heading into 2026.

Usman Salis

Usman Salis

Usman Salis

Usman Salis