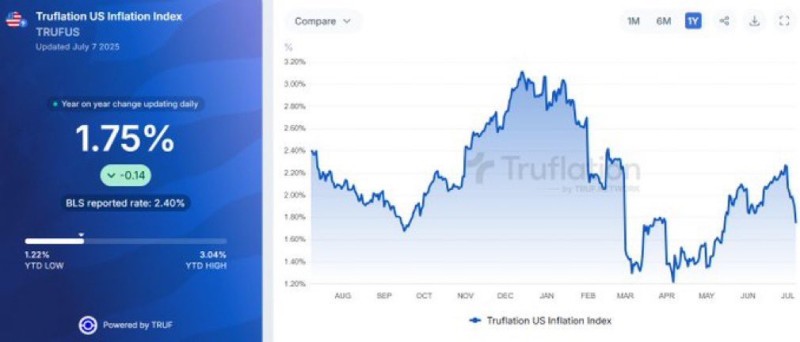

As inflation continues to cool across the U.S. economy, new data from Truflation reveals a significant drop in the annual inflation rate, signaling potential policy shifts from the Federal Reserve. The updated figures, released on July 7, 2025, suggest that inflation has now fallen below the Fed’s long-standing 2% target—raising hopes for interest rate cuts and renewed market optimism.

Inflation Drops to 1.75%, According to Truflation Data

US inflation has declined to 1.75% as of July 7, 2025. This marks a 0.52% decrease since June 29, highlighting a sharp short-term decline in consumer prices. The drop brings inflation below the Federal Reserve’s 2% target, fueling renewed speculation about upcoming rate cuts.

The official BLS-reported inflation rate remains higher at 2.40%, but Truflation’s real-time data paints a more optimistic picture, suggesting easing pressure on consumers and businesses alike.

Truflation Index Hits Multi-Month Low as Markets Brace for Fed Shift

The Truflation US Inflation Index, which updates daily, has shown significant volatility over the past 12 months—ranging between a 1.22% YTD low and a 3.04% high. The most recent reading of 1.75% is the lowest since March and suggests growing disinflation momentum.

If the trend holds, the Federal Reserve may face increasing pressure to lower interest rates, potentially fueling a bullish response in equity and bond markets. Investors will closely monitor upcoming Fed meetings for any policy pivots.

Usman Salis

Usman Salis

Usman Salis

Usman Salis