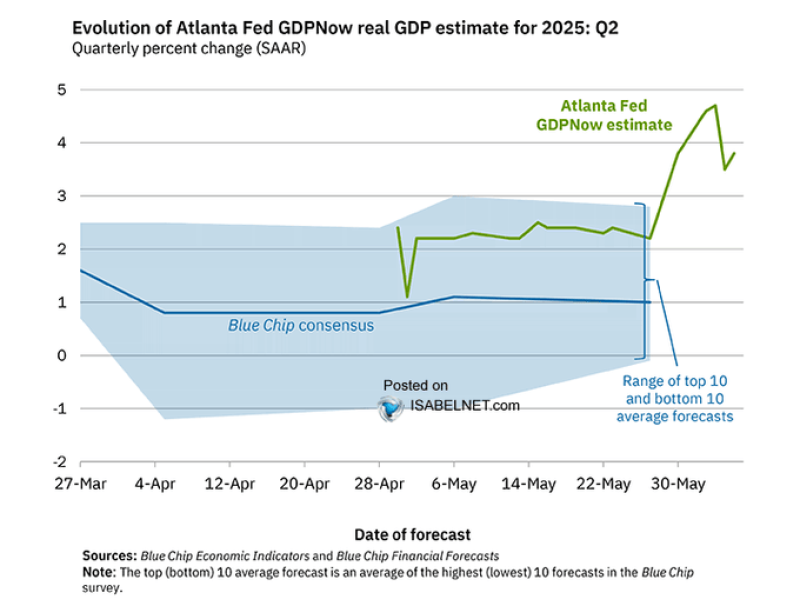

Atlanta Fed forecasts 3.8% U.S. GDP growth in Q2 2025, boosting confidence and driving S&P 500 futures higher.

Atlanta Fed Projects Strong Q2 Recovery

U.S. real GDP is projected to grow at an annualized rate of 3.8% in Q2 2025. This robust forecast suggests a strong rebound after a sluggish start to the year, reigniting optimism across financial markets.

The model's bullish outlook contrasts with the near-flat growth seen in Q1, as indicated by recent Eurostat data for other advanced economies. Traders are now recalibrating expectations for U.S. equities and interest rates, anticipating economic strength may delay potential Fed rate cuts.

S&P 500 Futures Rise on Growth Optimism

The upbeat GDP projection has had a direct impact on S&P 500 (SPX) futures, which climbed nearly 0.8% in early Friday trading. Investors view the 3.8% growth estimate as a signal of underlying economic resilience that could support corporate earnings into the second half of 2025.

As of this morning, S&P 500 futures trade around 5,450, hovering near all-time highs. With GDP momentum building, analysts suggest further upside is possible—especially if upcoming data aligns with the Atlanta Fed’s outlook. Traders are keeping a close eye on both inflation and consumer spending trends.

Will Growth Data Fuel More Gains in S&P 500 Price?

If the 3.8% Q2 GDP estimate materializes, it could validate the recent strength in S&P 500 price, which has gained over 12% year-to-date. A sustained rally might push the index above the 5,500 mark, driven by strong economic fundamentals rather than just liquidity flows.

However, some market participants remain cautious, noting that overly hot growth could also reignite inflation concerns. For now, SPX price action suggests traders are leaning bullish, with the growth narrative back in the spotlight.

Peter Smith

Peter Smith

Peter Smith

Peter Smith