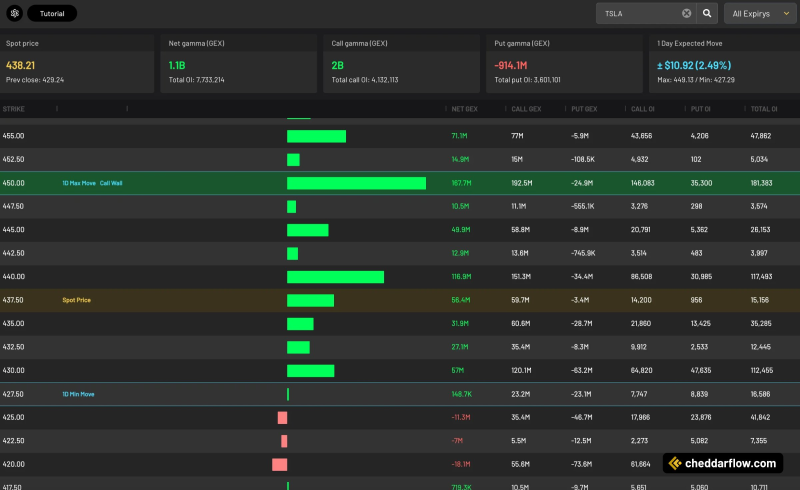

⬤ Tesla shares draw heavy options market interest because a thick block of call contracts sits at the 450-dollar strike. The gamma tied to that strike equals about 167 million dollars, the largest single cluster of calls along the entire board. With the stock near 438 dollars, the price rests a few points below this key options level.

⬤ Call gamma appears at multiple strikes - yet the 450-dollar line dominates with roughly 192.5 million dollars of call gamma and more than 181,000 contracts open. Each time Tesla rises, dealers who sold those calls must buy the stock to stay neutral - the price tends to get drawn toward 450 dollars.

Gamma stacks at nearby strikes show that option flows now steer Tesla's short term path.

⬤ Put gamma by contrast, stands at minus 914 million dollars, a large bet on lower prices even while calls rule the nearest term. Shares trade between 437 and 439 dollars and the market prices a one day range of about 11 dollars - a quick move to 450 dollars is plausible if buying persists.

⬤ When options volume swells, gamma can push the underlying price. As Tesla approaches 450 dollars hedging trades may swell volatility or add directional thrust. Whether 450 dollars acts as a lid or a springboard will depend on how dealers adjust their books inside this crowded strike.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi