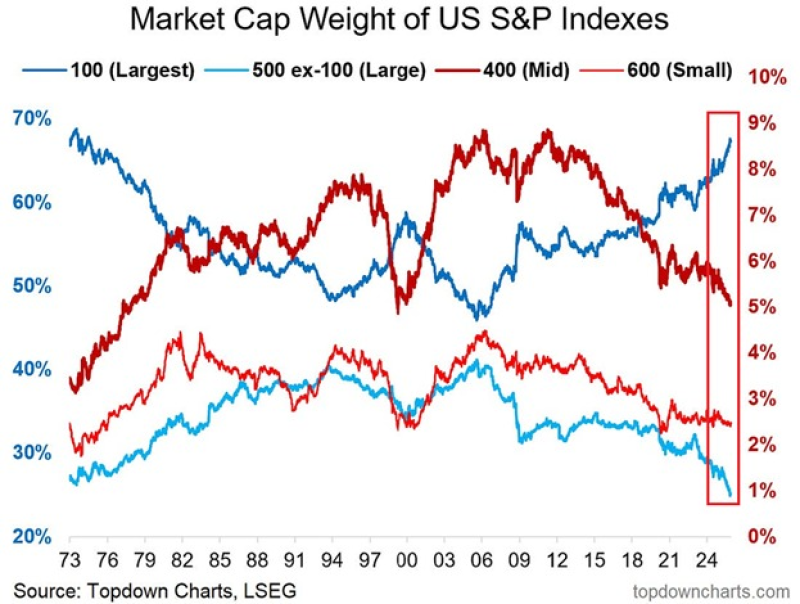

⬤ The U.S. equity market has become more concentrated than at any point in the past five decades. The largest companies now hold a record share of total value. The top 100 firms represent about 68 % of the entire U.S. market, the highest proportion since the 1970s. This trend highlights how far mega cap stocks have outpaced the rest of the market.

⬤ Over the past twenty years, the largest 100 companies have increased their share of the market by 23 percentage points. The remaining companies in the S&P 500 now account for only about 25 % of total market capitalization, the lowest level in at least 52 years. Mid-cap companies hold roughly 5 % of the market, down 4 percentage points over 14 years. Small-cap companies have fallen to nearly 2 %, close to their lowest levels since the Dot-Com era.

The growing performance gap between mega cap stocks and smaller companies reflects long term changes in market leadership.

⬤ This concentration signals a major shift in market dynamics. A small number of technology focused giants continue to attract capital, driven by cloud computing, artificial intelligence and large-scale platform business models. Smaller companies face higher borrowing costs and unstable earnings, which has broadened the gap over multiple years.

⬤ This situation is significant because the market now depends on a very small group of stocks. With 68 % of total value concentrated in just 100 companies, the market is more sensitive to price movements in those few names. The sharp decline in mid- and small-cap representation raises serious concerns about the sustainability of this top heavy structure and the potential consequences if those large companies experience setbacks.

Peter Smith

Peter Smith

Peter Smith

Peter Smith