America has crossed into unprecedented financial territory as credit card debt reaches all-time highs. While some economists point to consumer spending as a sign of economic strength, the numbers tell a different story - one of households increasingly relying on borrowed money just to keep up with everyday expenses amid persistent inflation and elevated interest rates.

Borrowing to Survive, Not Thrive

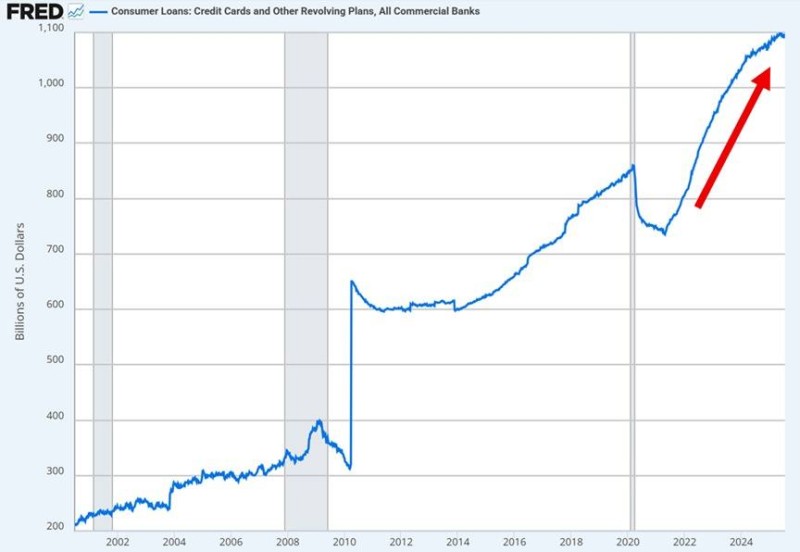

As REtipster's Seth Williams recently highlighted, American consumers have piled on $363 billion in new credit card debt since 2021. This isn't the spending pattern of confident households - it's families turning to plastic to bridge the gap between stagnant wages and rising costs.

The FRED data paints a stark picture. Before 2008, revolving debt hovered below $1 trillion with modest growth. The financial crisis triggered a sharp pullback, but since the pandemic hit in 2020, we've witnessed an uninterrupted climb that's pushed balances past $1.1 trillion by late 2024. The past three years represent the steepest uptrend in decades.

What's driving this? It's a brutal combination. Inflation continues eroding purchasing power faster than paychecks can grow, while credit card interest rates have shot past 20% - the highest on record. This isn't economic optimism - it's survival mode in a system where expenses consistently outrun income, and plastic fills the gap.

What This Means Beyond the Headlines

For investors, these numbers carry weight. Banks might be booking impressive interest income in the short term, but they're also facing rising delinquency risks as more cardholders struggle to keep up. Retailers may see sales propped up by debt-fueled purchases today, but that's borrowing from tomorrow's demand. If defaults climb and lenders tighten credit, the ripple effects could slow the broader economy considerably.

The real takeaway is about fragility. Record credit card debt isn't a sign of a healthy consumer base - it's a warning light on the dashboard. Spending financed by ballooning debt isn't sustainable growth; it's a red flag that household finances are stretched dangerously thin. For anyone watching these trends, the message is clear: building assets beats carrying balances that compound at record rates.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir