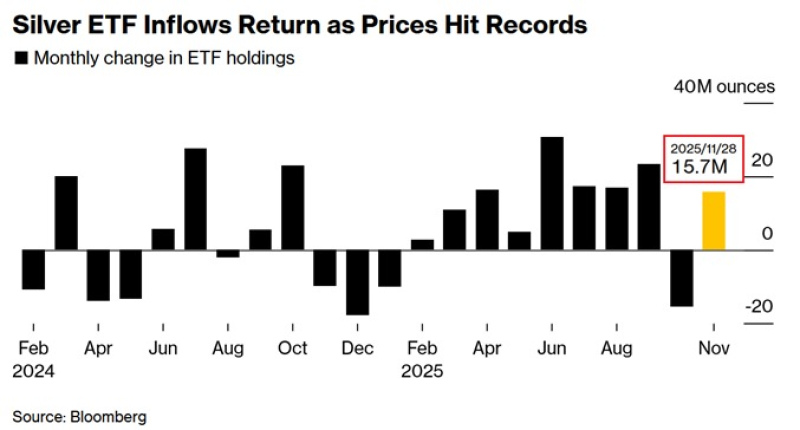

⬤ Silver ETF holdings rose by 15.7 million ounces in November as the metal's price kept climbing. Physical silver funds recorded one of the year's largest monthly inflows while XAG continued its advance. Investors bought the metal while its price rose fast.

⬤ ETF flows stayed positive throughout 2025; silver funds added metal in nine of the past eleven months. The options market looks even more bullish. Silver skew climbed eight percentage points in two weeks to reach ten percentage points, the highest premium for calls over puts since March 2022. Traders now wager heavily on further gains.

Silver has risen 101 percent this year, which places it on course for its second best annual result ever.

⬤ The data behind the rally stand out. XAG has gained 101 percent this year - only the 435 percent surge of 1979 was larger. November's inflow of 15.7 million ounces shows that investors added exposure while volatility increased. Mining shares and other metals linked assets also firmed.

⬤ This build up points to more than a routine commodities trade. Calls now cost their richest premium in over two years besides ETF holdings grow at 2025's fastest pace. Investors shift capital into hard assets as uncertainty rises. Strong price gains rising ETF holdings and aggressive options positioning together show steady confidence in silver while markets reappraise risk.

Peter Smith

Peter Smith

Peter Smith

Peter Smith