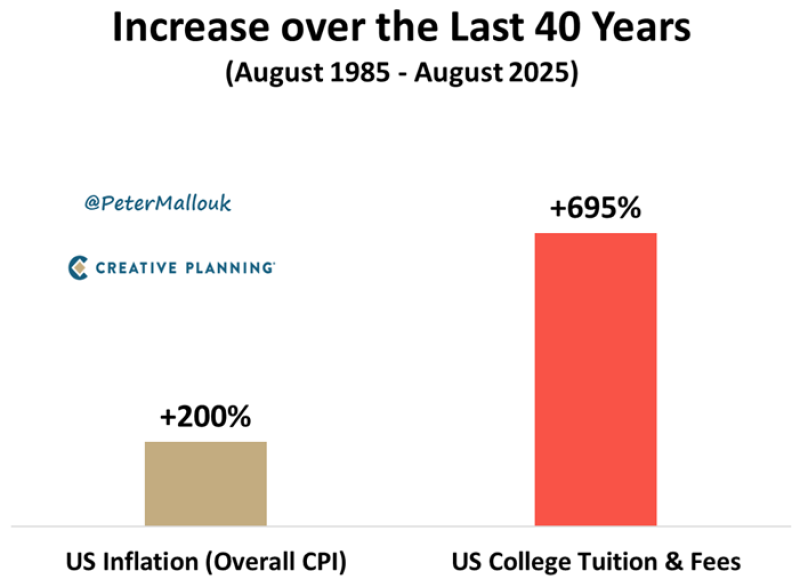

American families are facing an education cost crisis that's been brewing for decades. Since 1985, college tuition has exploded by an eye-watering 695% while everyday prices have risen a more modest 200%. This isn't just about numbers on a chart — it's reshaping how entire generations think about education, debt, and their financial futures.

The Tuition Explosion

The numbers tell a stark story. While your grocery bill and gas prices have roughly tripled over four decades, college costs have increased nearly sevenfold. This isn't normal economic behavior — it's more like watching a stock price in permanent rally mode, disconnected from fundamental realities.

What makes this particularly troubling is the consistency of the trend. Unlike other economic bubbles that show volatility, tuition costs have climbed relentlessly upward with barely a pause, even during recessions when families struggled most. The gap between tuition and inflation keeps widening each year, creating what economists call an unsustainable trajectory.

Why College Became So Expensive

The root causes run deeper than simple supply and demand. Easy access to federal student loans removed the natural price ceiling that cash-strapped families once provided. When students could borrow almost unlimited amounts, universities had little incentive to control costs. Meanwhile, state governments quietly shifted funding burdens from taxpayers to students, and colleges expanded administrative staff far beyond teaching faculty.

Perhaps most importantly, society convinced itself that college degrees were essential for middle-class life. This created captive demand — families felt they had no choice but to pay whatever universities charged, regardless of the financial strain.

The Broader Impact

Today's $1.7 trillion student debt mountain isn't just crushing individual borrowers — it's warping the entire economy. Young adults delay homeownership, avoid entrepreneurial risks, and postpone major life decisions because of education debt. The promised economic mobility that college was supposed to provide is being undermined by the very cost of obtaining it.

This creates a vicious cycle where the remedy becomes the disease. Higher education, designed to reduce inequality, now risks increasing it by pricing out middle-class families who earn too much for aid but too little to pay cash.

Looking Forward

Something has to give. The current trajectory means today's kindergarteners could face college bills exceeding $500,000 by the time they graduate high school. No economy can sustain that level of education inflation indefinitely.

The solution likely requires multiple approaches: loan reform to restore price discipline, alternative credentialing that bypasses traditional degrees, increased public investment, and universities themselves recognizing that their current model is unsustainable. The question isn't whether change will come — it's whether we'll choose managed reform or wait for market forces to impose a more painful correction.

Peter Smith

Peter Smith

Peter Smith

Peter Smith