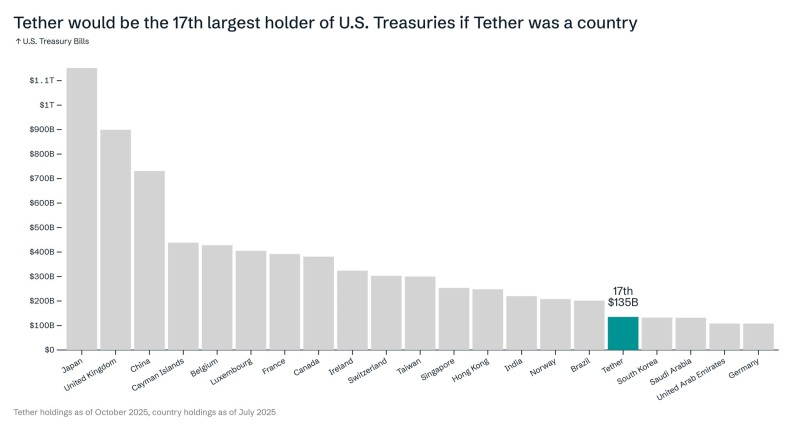

Tether, the world's leading stablecoin issuer, has quietly become one of the largest holders of American government debt. With $135 billion in U.S. Treasury bills, the company now sits at 17th place globally — a position that would typically belong to a sovereign nation, not a crypto firm.

Tether Climbs Global Debt Rankings

Recent data shared by Paolo Ardoino reveals that Tether has surpassed South Korea's holdings and is closing in on Brazil's $140 billion position.

This puts the stablecoin giant in direct competition with major economies when it comes to U.S. debt ownership. The scale is remarkable: a private company operating in the crypto space now manages a Treasury portfolio comparable to entire countries.

Chart Highlights: Sovereign-Level Holdings

Japan leads the pack with over $1.1 trillion in U.S. debt, followed by the United Kingdom and China. But Tether's placement on this list tells a bigger story about how digital currency companies have matured. What started as an experimental corner of finance has evolved into a system that moves billions and backs its operations with traditional government securities. At its current trajectory, Tether could overtake Brazil within months, further cementing its role in short-term dollar markets.

Why It Matters

Tether's Treasury strategy serves dual purposes: it generates yield while ensuring the liquidity needed to maintain its stablecoin peg. This massive exposure to U.S. government debt highlights how deeply crypto has woven itself into traditional finance. The holdings aren't just about backing USDT tokens — they represent genuine demand for dollar-denominated assets in a digital ecosystem that spans borders and operates around the clock.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi