Retail investors have made history with an unprecedented $100 billion surge into the stock market over the past 30 days. This massive wave of individual investor activity has shattered previous records and signals a dramatic shift in market dynamics as everyday traders cement their role as a major force in equity markets. This surge has also accelerated demand for sophisticated trading platforms, prompting many brokerages to seek out a retail software development company that can handle increased user volumes and deliver seamless digital experiences.

Historic Surge in Retail Demand

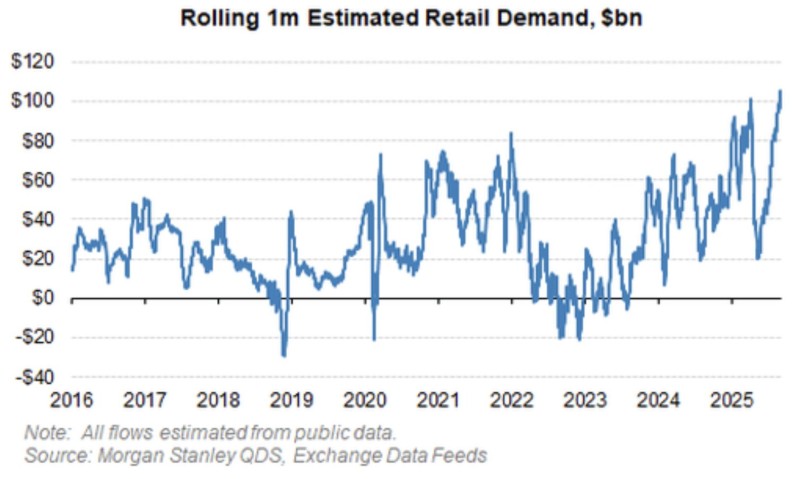

According to recent analysis shared by a Barchart trader, retail investors pushed more than $100 billion into equities over the last month, marking an all-time record for monthly inflows.

The data reveals rolling one-month estimated retail demand reaching levels never seen before in 2025, easily surpassing the peaks during both the 2021 meme stock frenzy and the 2020 post-pandemic market rally.

What the Numbers Show

Morgan Stanley's quantitative data confirms this historic moment. Retail demand blasted past the $100 billion threshold in 2025, establishing a new benchmark that towers over any previous period. The acceleration has been remarkable, with retail participation climbing sharply after hovering between $20 and $60 billion throughout 2023 and 2024. This current surge completely overshadows earlier retail manias, including the wild 2021 trading period that sent stocks like GameStop and AMC soaring. The data points to an incredibly powerful wave of retail conviction, with money pouring into markets at a pace unseen in nearly a decade of tracking.

What's Behind the Buying Spree?

Several factors appear to be driving this explosion in retail activity:

- The tech and AI boom has captivated individual investors, with massive interest in heavyweight names like Nvidia, Microsoft, and AMD

- Improving economic signals, including softer inflation numbers and expectations of potential interest rate cuts, have boosted confidence

- Social media platforms continue fueling coordinated retail participation and sharing investment ideas

- Expanded access to ETFs and options trading, including leveraged products, has amplified retail trading activity

What This Means Going Forward

The massive inflows clearly demonstrate bullish sentiment among individual investors, but history offers a cautionary note. When retail demand reaches extreme levels like this, it can sometimes signal vulnerability rather than strength. If market momentum fades, retail traders could find themselves heavily exposed at potentially elevated prices.

The $100 billion retail surge confirms that individual investors have evolved into a dominant force capable of moving markets. Whether this marks the beginning of a sustained rally or represents a potential warning sign is the question facing investors today. What's certain is that retail traders are no longer just along for the ride - they're driving it.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah