A key manufacturing cost indicator just flashed a warning signal that could reshape inflation expectations and Federal Reserve policy decisions in the months ahead.

PPI Price Signals Renewed Inflation Pressures

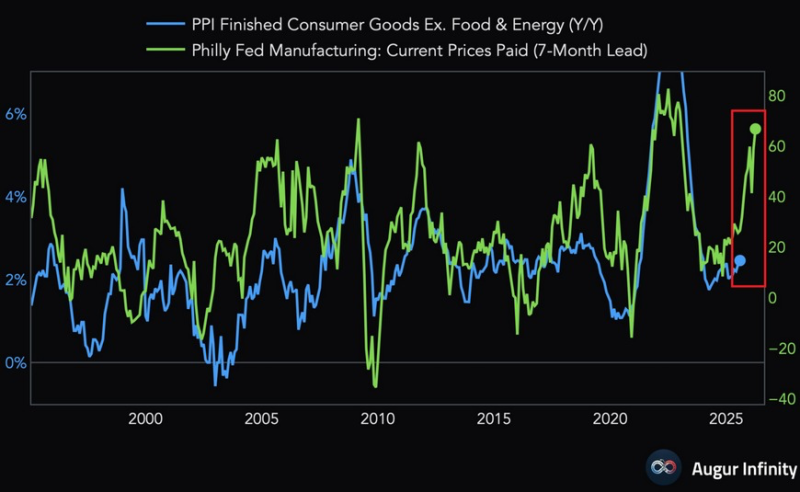

Market analyst @KobeissiLetter highlighted the sharp move. The Philly Fed Prices Paid Index jumped 8 points to 66.8 in August—its highest reading since May 2022. This metric tracks what manufacturers pay for raw materials, and it's been climbing steadily over the past year.

The surge matters because this index historically predicts where producer prices are heading. Market watchers have noted the strong correlation: the Philly Fed indicator typically leads the Producer Price Index for Finished Consumer Goods (excluding food and energy) by about seven months.

Philly Fed Surge Points to Higher PPI Price Levels

At 66.8, August's reading signals that inflationary pressures are building just as the economy may be entering an easing cycle. Current producer-level inflation sits around 2% year-over-year, but if past patterns repeat, we could see that number climb in coming quarters.

The timing is notable. When this index last hit similar levels in 2022, the U.S. faced its worst inflation surge in decades, pushing the Federal Reserve into aggressive rate hikes.

What Rising PPI Prices Mean for Markets and Policy

Higher producer costs don't stay isolated—they typically flow through to consumer prices. When manufacturers face rising input costs, they eventually pass those increases to buyers.

This creates a policy headache for the Fed, which has been considering rate cuts. Rising producer inflation could force policymakers to keep rates higher for longer.

For markets, the implications cut both ways. Manufacturing stocks might struggle under cost pressures, while commodities could benefit from increased demand. Bond investors are watching closely—any inflation resurgence could push yields higher and derail expectations for easier monetary policy.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah