Jerome Powell just laid out the scariest scenario for any central banker. Speaking recently, he echoed the same warning from July: "Risks to inflation are tilted to the upside, and risks to employment are tilted to the downside." Translation? We're getting higher prices and fewer jobs at the same time.

The Numbers Don't Lie

As The Kobeissi Letter noted, this is textbook stagflation territory - exactly what policymakers dread most.

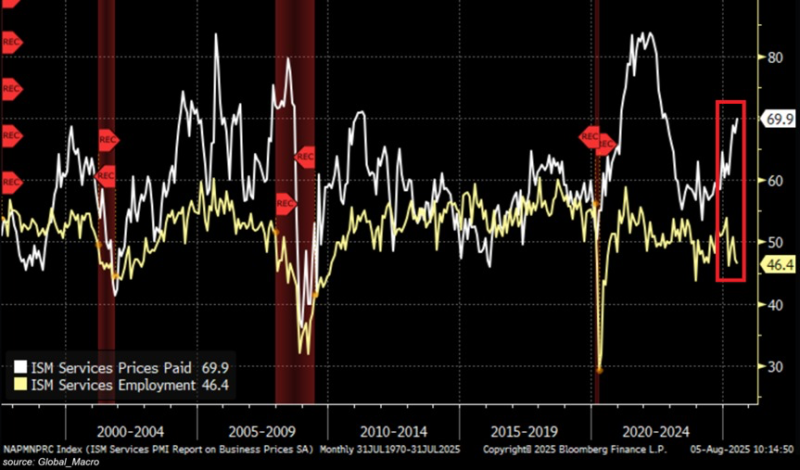

The latest ISM data paints a brutal picture. Services prices just hit 69.9, showing massive inflationary pressure in the biggest part of our economy. Meanwhile, services employment crashed to 46.4, well below the 50 line that separates growth from contraction. This isn't just concerning - it's historically what happens right before recessions hit.

Why This Matters Right Now

The Fed is completely boxed in here. Cut rates to help jobs? You'll make inflation worse. Keep rates high to fight prices? You'll kill more jobs. This kind of split between rising costs and falling employment is the sharpest we've seen since the pandemic mess. Powell knows there's no easy way out of this one.

Powell's warnings combined with these numbers show just how tough things are getting. When you have sticky inflation alongside weakening employment, you're looking at stagflation - the economic nightmare that makes both stocks and bonds sweat. The Fed's walking a tightrope, and right now it's not clear which way they'll fall.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah