Financial markets are moving in ways that defy conventional wisdom. The Federal Reserve is cutting rates while inflation and growth remain elevated - a scenario made even more unusual by a 7% budget deficit. This combination creates a market environment unlike anything we've seen before, making comparisons to past cycles potentially misleading.

No Historical Blueprint for the Current Cycle

Rev Cap recently noted that this market cycle resembles nothing from the past. Normally, central banks lower rates when inflation cools and economic growth slows.

But today we're seeing the opposite: monetary easing alongside persistent inflation and strong growth. This fundamental difference means investors can't rely on historical patterns to guide their decisions.

Why 1999 Comparisons Fall Short

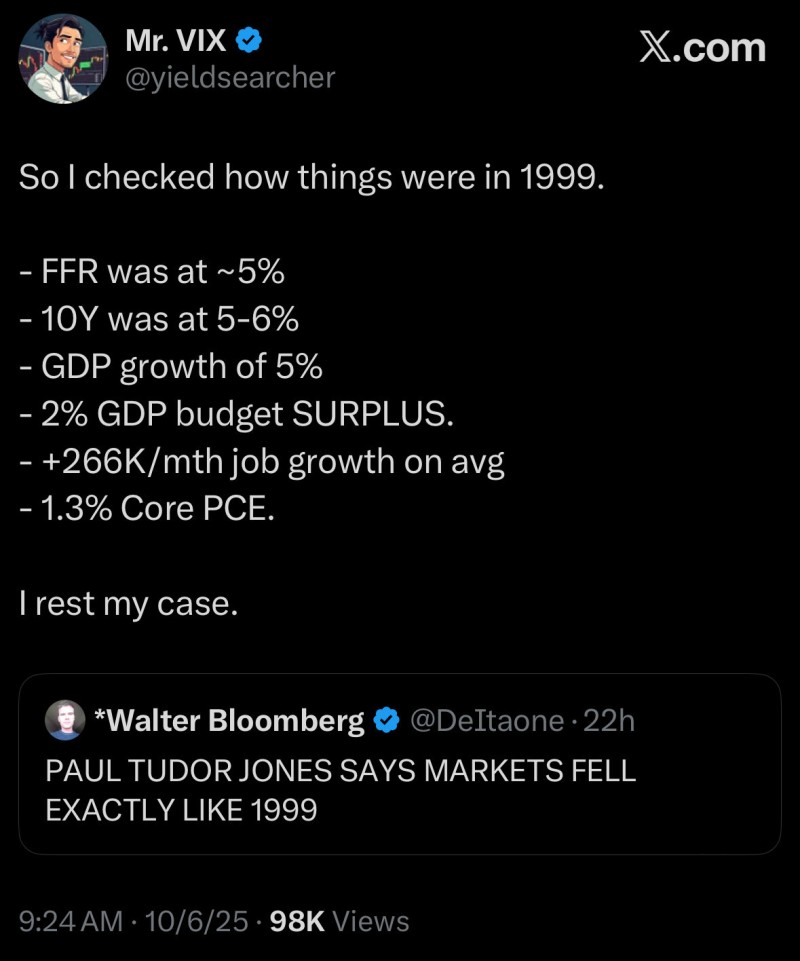

Market analyst Mr. VIX pointed out key differences between then and now. Back in 1999, the U.S. had Fed funds around 5%, Treasury yields between 5-6%, GDP growth of 5%, a 2% budget surplus, monthly job gains averaging 266K, and core inflation at just 1.3%. Fast forward to 2025: we're running a 7% deficit with significantly higher inflation. The fiscal picture alone makes these eras incomparable, despite some surface-level similarities in rates and growth.

What This Means for Markets

This unusual setup creates mixed signals: robust job creation and GDP growth support risk assets, but inflationary pressure combined with rate cuts distorts normal market relationships and raises volatility risk. The massive government deficit amplifies vulnerability to economic shocks, adding another layer of uncertainty. Strong growth provides a cushion, yet the policy mix creates correlations we haven't navigated before.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah