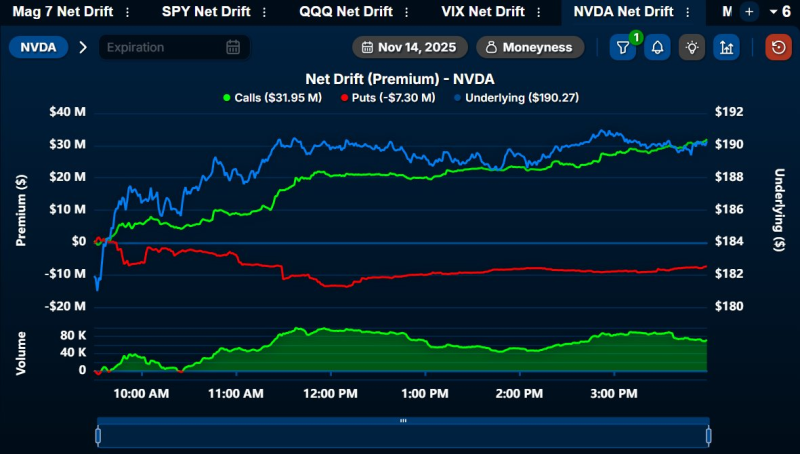

⬤ Nvidia grabbed serious attention on Friday as traders piled into short-dated call options. More than $32 million in call premium hit the market during the session, shown by the sharp uptick in the chart's green line. The stock spent most of the day hovering near $190, while call demand picked up steam throughout trading hours.

⬤ Put options told a different story, ending the day down around $7.3 million. This split between heavy call buying and declining put interest points to bullish positioning focused on the upcoming earnings event. Even though NVDA's price stayed relatively tight between $187 and $191, call interest kept climbing—suggesting focused speculation rather than broader market movement.

⬤ Volume data backs this up. Afternoon trading saw a notable jump in call contracts, reflected in the rising green bars at the chart's bottom. Meanwhile, the underlying price in blue stayed steady, showing that options activity—not price swings—drove Friday's market action. The overall trend across calls, puts, and the stock itself shows consistent buildup of bullish bets.

⬤ This call-option surge matters because Nvidia's earnings typically set the tone for the semiconductor and AI hardware sectors. The heavy buying of short-dated calls suggests traders expect positive surprises in next week's report, possibly around AI demand, data-center revenue, or new product launches. With markets watching Nvidia's AI supply chain role closely, Friday's positioning reflects growing confidence and appetite for risk heading into earnings.

Peter Smith

Peter Smith

Peter Smith

Peter Smith