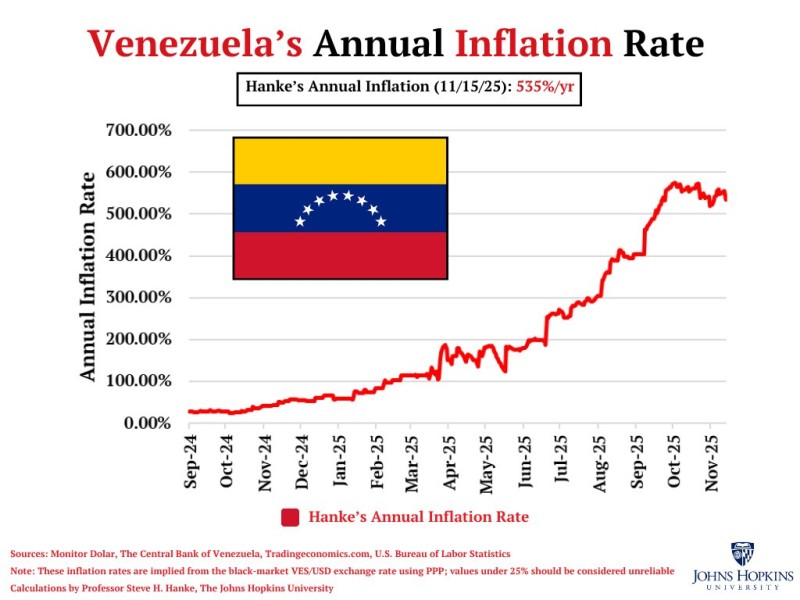

⬤ Venezuela's inflation rate has skyrocketed to 535% as of mid-November, marking one of the sharpest increases globally this year. The newly released chart tracks a steep climb throughout 2025, showing how persistent monetary instability continues to push annual inflation into extreme territory—hammering households and businesses across the country.

⬤ The chart follows Venezuela's annual inflation from late 2024 through November 2025, revealing a clear shift from moderate levels to rapid acceleration. After hovering lower in the final months of 2024, inflation started climbing steadily at the start of 2025, crossing 100% by March. The pace picked up over the summer, surging past 300% by June, and kept climbing to reach the current 535% mark. The upward curve is unmistakable, with the Venezuelan flag positioned at the center to emphasize the national scope of the crisis.

⬤ The inflation figures are calculated using the black market VES/USD exchange rate through purchasing power parity, pulling data from Monitor Dolar, the Central Bank of Venezuela, TradingEconomics, and the U.S. Bureau of Labor Statistics. The methodology was developed by Professor Steve Hanke of Johns Hopkins University. A note on the chart warns that readings below 25% may be less reliable due to distortions in parallel market pricing.

⬤ This kind of explosive inflation matters because it destroys purchasing power, shakes domestic confidence, and destabilizes the entire economy. When prices spiral this fast, the effects ripple beyond national borders—impacting regional financial conditions and shaping expectations for future policy moves. Venezuela's inflation trajectory remains a critical flashpoint in discussions around global economic risk.

Usman Salis

Usman Salis

Usman Salis

Usman Salis