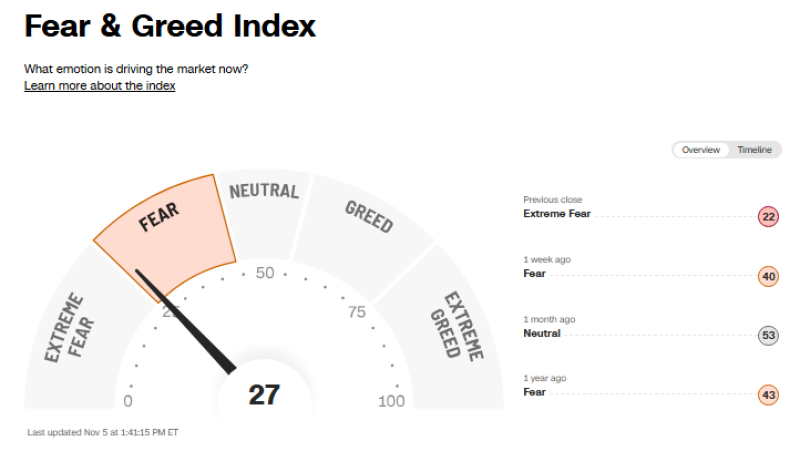

The stock market is showing early signs of emotional recovery after weeks of panic-driven sentiment. The CNN Fear & Greed Index has climbed to 27, moving out of the Extreme Fear zone into Fear. This shift signals that investors are beginning to regain confidence, even if caution still dominates market behavior.

Fear & Greed Index: Measuring Investor Psychology

According to data shared by Barchart trader analysis, the index tracks seven market indicators including price momentum, volatility, trading volume, and demand for safe-haven assets to determine whether investors are acting out of fear or greed. A reading near 0 signals panic, while levels near 100 reflect euphoria.

As of November 5, the index stands at 27 (Fear), up from 22 (Extreme Fear) at the previous close, 40 one week ago, and 53 a month ago. The recent upward move suggests the market may have passed its most fearful phase, with sentiment stabilizing even as risk aversion remains elevated.

What's Driving the Improvement

Several factors are contributing to the recovery in sentiment. Cooling inflation data has eased investor anxiety about additional rate hikes, while earnings season resilience, especially in tech and financials, has restored some confidence. Reduced market volatility and steady Treasury yields are signaling that conditions may be stabilizing. This combination has shifted the market mood from panic to cautious optimism, with investors beginning to step back into risk assets after the sharp downturns of recent months.

Historical Perspective: What "Fear" Means for Markets

Historically, extreme fear often coincides with short-term market bottoms, as panic selling exhausts itself, while excessive greed tends to precede local tops. The index's current recovery from 22 to 27 suggests that while pessimism remains, the worst phase of capitulation may be behind. Many traders interpret such moves as potential opportunities to accumulate positions at lower valuations, particularly in sectors that have shown resilience.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi