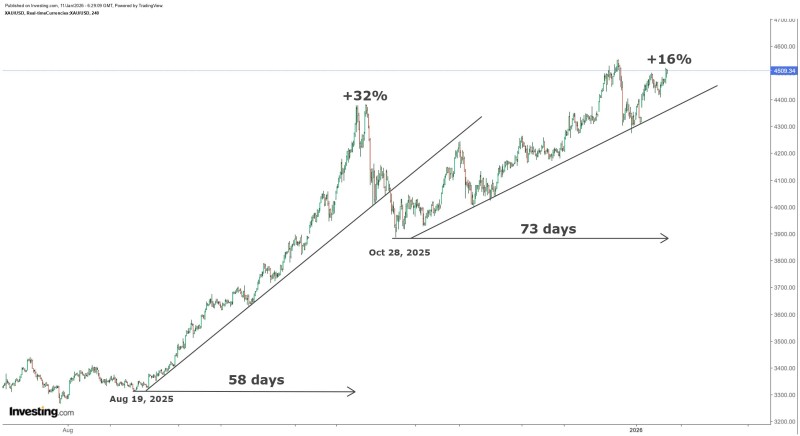

⬤ Gold has kept pushing higher, but the character of the move has changed noticeably. The rally that started in mid-2025 has entered a calmer phase, with prices climbing at a steadier pace rather than the sharp acceleration that defined the earlier advance. Chart analysis reveals two distinct phases in this uptrend, with the trendline becoming visibly flatter since late October 2025.

⬤ The initial surge delivered impressive results—gold jumped roughly 32 percent over just 58 days between August 19 and October 17, 2025. That period featured a steep trajectory and rapid gains. After pulling back and establishing a low on October 28, the metal began climbing again, this time adding about 16 percent over the following 73 days. The difference in slope between these two phases tells an important story about shifting momentum.

⬤ While the earlier rally produced dramatic gains in compressed timeframes, the current advance shows tighter price swings and a more controlled climb. Gold continues making higher highs and higher lows, maintaining bullish structure even as the angle of ascent has softened. Support levels remain intact, suggesting the uptrend hasn't broken down—it's simply evolved into something less aggressive.

⬤ This transition toward gradual appreciation actually carries positive implications for trend sustainability. Sharp vertical rallies often invite equally sharp corrections, whereas steady climbs tend to build more durable foundations. As gold maintains upward momentum without overheating, markets continue weighing macro factors, central bank policy direction, and gold's enduring appeal as a wealth preservation asset.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi