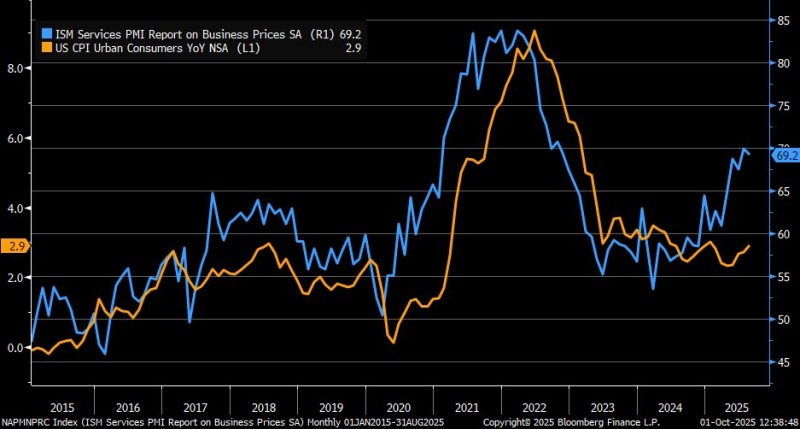

The ISM Services PMI prices index has surged to 69.2, while U.S. CPI remains at 2.9%. This widening gap suggests inflationary pressures could pick up steam in the months ahead, creating potential headwinds for both monetary policy and markets.

Market Context: Services Prices vs. CPI

For over a decade, the ISM Services "prices paid" index has acted as a leading indicator for U.S. consumer inflation. While not perfect, CPI tends to track the ISM Services prices index with a meaningful delay.

As trader Liz Ann Sonders has noted, this lag effect has proven reliable across cycles.

Right now, ISM Services prices are climbing sharply while CPI has settled just below 3%. If past patterns hold, we could see renewed upward pressure on consumer prices soon.

What the Data Show

The chart covering 2015–2025 tells a clear story. During 2021–2022, ISM's sharp jump preceded CPI's climb above 9%. In 2023, as ISM cooled, CPI eventually followed lower. Now in 2025, ISM has bounced back toward 70 while CPI hovers near 2.9%, pointing to potential catch-up pressure ahead.

Several factors explain the firming services inflation: tight labor markets keeping wage growth elevated, rising energy prices feeding through to transport and utilities, and strong consumer spending on travel, dining, and entertainment. This mix reinforces the stickiness of services inflation even as goods prices have stabilized.

If CPI tracks higher, expectations for Fed rate cuts could get pushed out. That would likely mean elevated bond yields, renewed equity volatility, and a stronger dollar. Investors should prepare for inflation to remain above the Fed's 2% target well into 2025.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah