Consumer inflation expectations just delivered an unwelcome surprise. After steadily declining for four months, Americans are once again bracing for higher prices ahead. The latest Conference Board data shows a clear shift in sentiment that could complicate the Federal Reserve's battle against inflation and reshape market expectations for the months ahead.

This uptick matters more than typical economic data points because it captures what real people think about future prices—and those expectations have a way of becoming self-fulfilling prophecies in the economy.

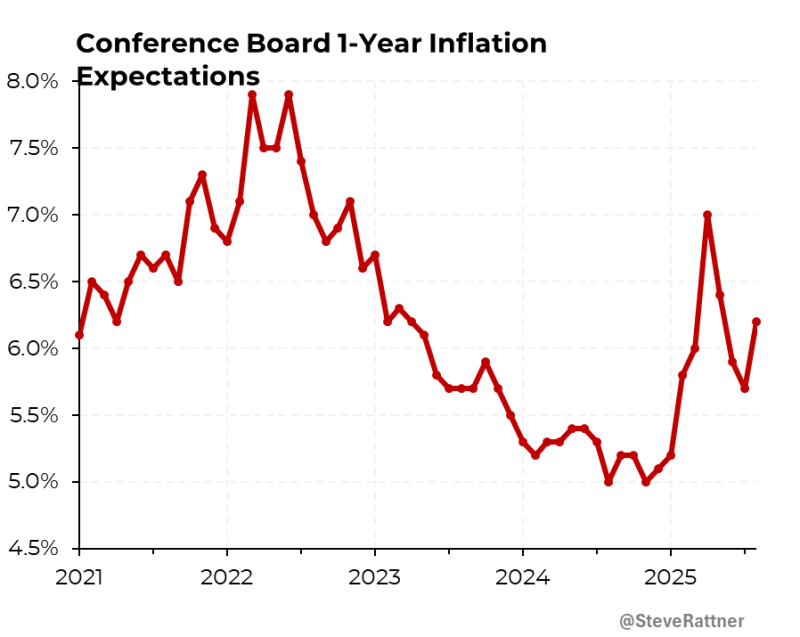

Inflation Price Expectations Break Four-Month Trend

Americans are getting nervous about prices again. The Conference Board's closely watched inflation expectations index jumped from 5.7% in July to 6.2% in August—the first increase since April and a clear break from the improving trend we'd been seeing.

Market analyst Steve Rattner highlighted this shift, noting how consumer sentiment appears to be turning more pessimistic about future price pressures. After months of gradual improvement, this reversal suggests people are starting to worry that the inflation fight isn't over yet.

Why Inflation Price Expectations Matter

Here's the thing about inflation expectations—they're not just numbers on a chart. When people expect higher prices, they often act in ways that make those higher prices more likely to happen. They might rush to buy things now before they get more expensive, or demand bigger raises to keep up with anticipated cost increases.

This creates a feedback loop that central bankers dread. Higher expectations can lead to actual higher inflation, making the Fed's job much harder. It's like trying to calm a crowd while they're getting more worked up.

Broader Implications for Policy and Markets

The timing couldn't be more challenging for policymakers. Just when inflation seemed to be stabilizing around 5% through 2024, we're seeing fresh concerns emerge in 2025. The August jump in expectations has caught the attention of both investors and Fed officials who were hoping for a smoother path back to their 2% target.

For markets, this shift is already causing ripple effects. Investors are rethinking their positions in everything from stocks to gold, Bitcoin, and Ethereum as they hedge against potential purchasing power erosion. The big question now is whether August represents a temporary blip or the start of a more worrying trend.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah