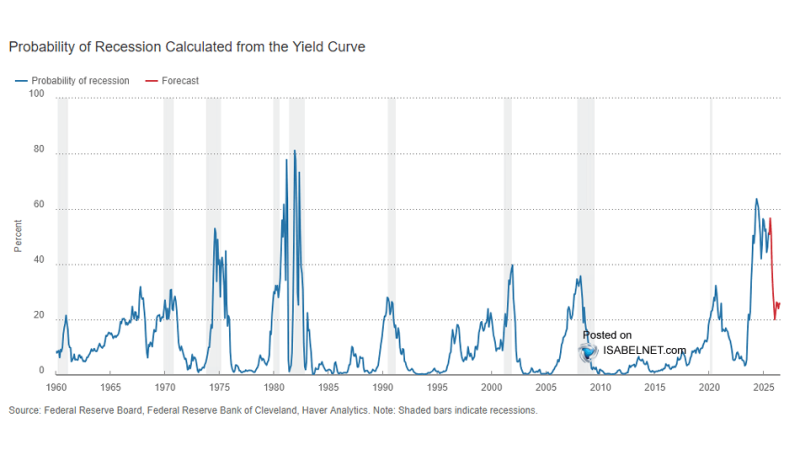

Remember when everyone was panicking about an inevitable recession? The yield curve—Wall Street's favorite crystal ball—is finally showing some relief, and traders are exhaling after months of uncertainty.

Yield Curve Shows Lower Recession Risk

The odds of a U.S. recession over the next 12 months have taken a sharp dive. According to data from @ISABELNET_SA, the yield curve model now puts recession probability at just 25.7%.

That's a huge drop from the scary 60%+ readings we saw earlier. When this indicator hits those heights, it's usually game over for the economy. The yield curve has earned its reputation as the recession whisperer—since the 1960s, every inversion has been followed by a recession like clockwork.

The twist this time? We saw probability rocket past 60% in 2023, yet the U.S. economy kept chugging along thanks to resilient consumers, a solid job market, and smart policy moves.

Historical Trends in Recession Probability

This indicator has called every major meltdown—from the 1970s recessions through the dot-com crash and 2008 crisis. Each spike was followed by economic trouble.

At 25.7%, we're still not in the clear, but it feels like we might actually pull off the elusive "soft landing" everyone's hoping for.

While 25.7% isn't exactly comforting, it's way better than the alarm bells ringing months ago. If trends keep improving and inflation cools, the Fed might cut rates next year, pushing recession odds even lower.

But this indicator still deserves respect. One curveball from global markets or geopolitical chaos could flip the script fast. For now though, the yield curve is throwing investors a bone.

Peter Smith

Peter Smith

Peter Smith

Peter Smith