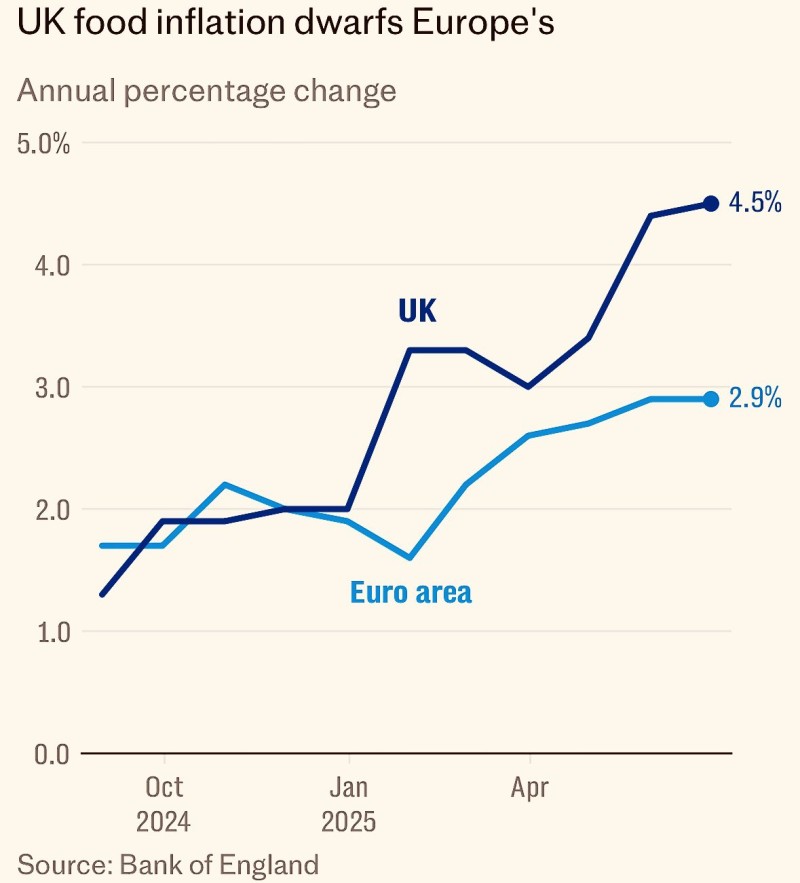

British families are feeling the pinch like never before. While politicians debate economic policy, real people are making tough choices at the grocery store, cutting back on essentials, and watching their paychecks stretch thinner each month. The numbers tell a stark story: UK food inflation has hit 4.5% annually, leaving European neighbors in the dust at a more manageable 2.9%.

This isn't just about statistics—it's about families choosing between heating and eating, parents skipping meals so their kids can have enough, and entire communities watching their standard of living slip away. The gap between Britain and Europe isn't just widening; it's becoming a chasm that threatens to define a generation's economic experience.

UK Inflation Price Hits Households Hard

Walk into any British supermarket and you'll feel it immediately. The same basket of groceries that cost £100 last year now runs closer to £105. Meanwhile, families across the Channel are dealing with much gentler price increases.

Financial analyst James Melville wasn't pulling punches when he pointed out that British households are getting hammered compared to their European counterparts. It's not just bad luck—there are real structural problems at play. Brexit trade complications, energy market chaos, and policy decisions that seemed smart at the time are now coming back to bite ordinary families.

The Bank of England's data paints a grim picture, but behind every percentage point are real people making real sacrifices.

UK vs Euro Area: A Growing Divide

The numbers don't lie:

- UK food inflation: 4.5% and climbing

- Euro area: holding steady at 2.9%

- The gap has been widening since early 2025

While countries like Germany and France have managed to keep their food costs relatively under control, Britain seems stuck in an inflationary spiral. Supply chains that still haven't recovered from Brexit disruptions, energy costs that refuse to come down, and import duties that get passed straight to consumers—it's a perfect storm hitting kitchen tables across the country.

Why UK Inflation Price Matters

This isn't just about expensive groceries. When food inflation runs this hot for this long, it changes how people think and behave. Families start making different choices, businesses struggle to plan, and the whole economy gets dragged down.

The Bank of England is caught between a rock and a hard place. Raise interest rates and you risk crushing an already fragile recovery. Do nothing and inflation expectations could get baked in for years to come.

Here's what's driving the pain:

- Energy bills: Even though wholesale prices have eased, families are still locked into expensive tariffs that feel punitive.

- Tax burden: Higher taxes are eating into budgets that were already stretched thin.

- Utility costs: Water bills are set to rise again later this year, adding insult to injury.

No wonder people feel like they're being taken for a ride.

Outlook: Can the UK Regain Control?

At 4.5% food inflation, Britain is dealing with one of Europe's toughest cost-of-living crunches. Without some serious intervention—whether that's targeted help for struggling families, fixing broken supply chains, or tackling the energy market mess—this crisis could drag on well into 2026.

The gap with Europe isn't just embarrassing; it's a warning sign that something fundamental isn't working. British families deserve better than watching their living standards erode while their neighbors across the Channel maintain stability.

Right now, the data speaks louder than any political promise: Britain has an inflation problem, and ordinary families are paying the price.

Usman Salis

Usman Salis

Usman Salis

Usman Salis