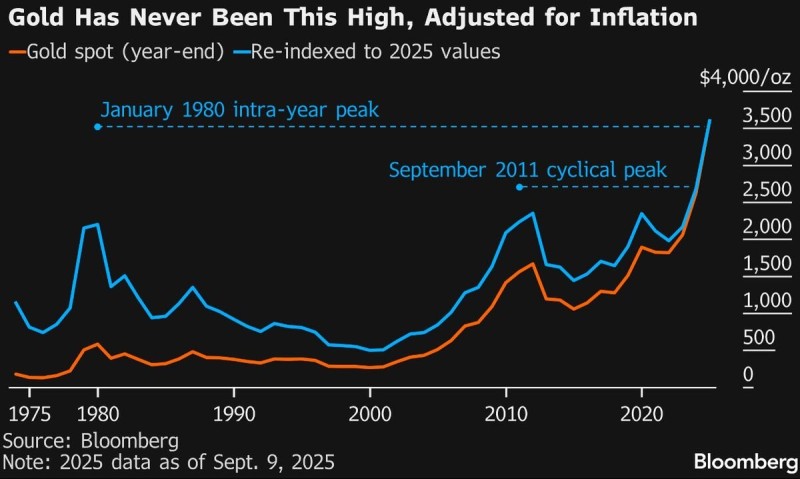

Gold has achieved a remarkable milestone by reaching its highest level ever when adjusted for inflation, surpassing both the legendary 1980 and 2011 peaks. This development represents more than just another price record – it signals a fundamental shift in how investors view precious metals amid persistent inflationary pressures and mounting global uncertainties.

Gold's Unprecedented Breakout

The precious metal has entered uncharted territory in real purchasing power terms. Recent data confirms that gold has never traded at these inflation-adjusted levels in modern history.

As noted by analyst Menthor Q, when Bloomberg's pricing data is re-indexed to reflect 2025 dollar values, the metal now trades above both the January 1980 intra-year peak and the September 2011 cyclical high, effectively reaching over $3,500 per ounce in today's purchasing power.

This breakthrough is particularly significant because it demonstrates that the current rally isn't merely keeping pace with inflation – it's actually outperforming it substantially. Unlike previous bull markets that were primarily driven by specific crisis events, today's advance appears to be built on more diverse and potentially lasting foundations.

Why Is Gold Rising?

Several interconnected factors are driving this historic performance:

- Inflationary Pressure: Despite central bank efforts, persistent inflation continues eroding fiat currency purchasing power, making gold increasingly attractive as a store of value

- Geopolitical Tensions: Escalating conflicts worldwide and growing economic instability are pushing investors toward traditional safe-haven assets

- Central Bank Demand: Record-breaking purchases from central banks globally have provided crucial structural support to prices

- Debt and Currency Risks: Mounting government debt levels across developed nations have weakened confidence in traditional currency systems

The combination of these factors creates a uniquely supportive environment for gold prices that differs markedly from previous bull market periods.

Historical Context

Understanding gold's current position requires examining its previous major peaks. The 1980 surge was primarily driven by runaway inflation and acute geopolitical crises, particularly the Iran hostage situation and Soviet invasion of Afghanistan. The 2011 peak emerged from the aftermath of the global financial crisis combined with European sovereign debt concerns.

Today's breakout differs fundamentally from both historical episodes. While previous rallies were largely reactive to specific crisis events, the current advance reflects broader institutional adoption and systematic concerns about currency debasement. This suggests the rally may prove more durable than its predecessors, which were followed by significant corrections once immediate crisis conditions subsided.

Market Implications

The inflation-adjusted breakthrough carries important implications for investors and portfolio managers. Traditional analysis based on nominal price levels may no longer provide adequate guidance, as real purchasing power metrics suggest gold has entered genuinely new territory. This could attract additional institutional interest from pension funds and endowments seeking long-term inflation protection.

However, investors should remain aware that even the most compelling fundamental trends can experience significant short-term volatility. If current momentum continues, gold could potentially test the psychological $4,000 per ounce level, though history suggests caution regarding possible corrections similar to those following past major peaks.

Usman Salis

Usman Salis

Usman Salis

Usman Salis