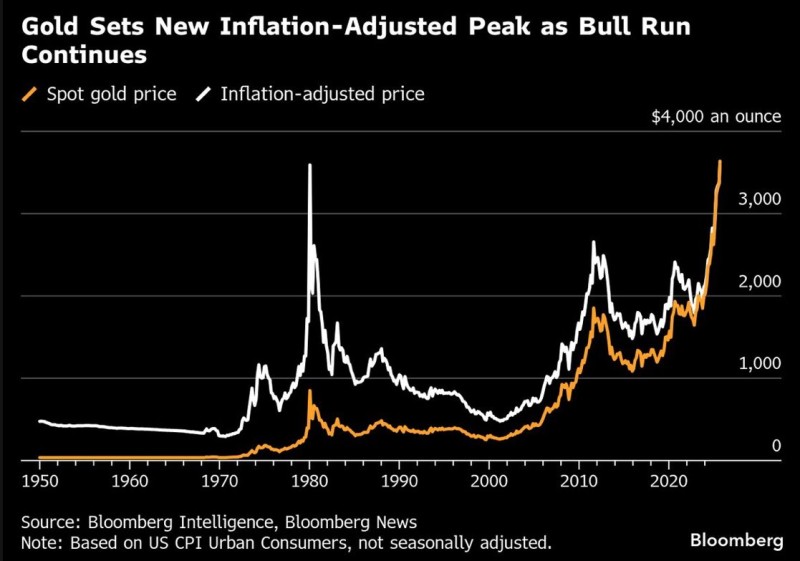

Gold just achieved something remarkable - breaking through its inflation-adjusted peak for the first time since the late 1970s. With spot prices soaring above $3,000 per ounce, investors are asking whether this precious metal still has room to run or if they've missed the boat entirely.

Gold's Historic Breakthrough

Trading expert David Ingles recently highlighted how gold has finally surpassed the inflation-adjusted highs from nearly five decades ago.

Looking at the Bloomberg chart, gold consistently rallies during periods of economic stress - whether it was the stagflation of the 1970s, the 2008 financial meltdown, or the pandemic chaos of 2020. This latest surge reinforces gold's reputation as the ultimate safe-haven asset when uncertainty reigns.

Breaking Decades of Resistance

The technical picture tells a compelling story. Spot gold has pushed past $3,000 per ounce while inflation-adjusted prices have shattered a ceiling that held firm since the 1980s. Perhaps most importantly, each major gold cycle has established higher support levels over time, creating what looks like a long-term "stair-step" pattern of growth.

This breakout above multi-decade resistance suggests we might be witnessing the start of a new structural bull market in gold.

What's Driving This Rally

Several factors are converging to push gold higher: inflation remains stubbornly persistent despite aggressive policy tightening, potential interest rate cuts would reduce real yields and make non-yielding gold more attractive, ongoing geopolitical tensions from conflicts and trade disputes boost safe-haven demand, and a weakening U.S. dollar makes gold cheaper for international buyers.

The Road Ahead

History offers both encouragement and caution for gold investors. While sharp corrections often follow strong rallies, the long-term inflation-adjusted trend points decidedly higher. A move toward $4,000 per ounce over the next few years seems plausible if current macro conditions persist. However, investors should prepare for potential pullbacks if inflation cools faster than expected or bond yields stage a comeback.

The question isn't whether gold will face volatility - it will. The question is whether this historic breakout marks the beginning of gold's next major chapter.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah