New inflation reports from several advanced economies show that price pressures are quietly picking up steam around the world—yet markets and policymakers seem oddly unconcerned. The latest data reveals a synchronized rise across Sweden, Australia, Canada, South Korea, and the UK, suggesting that global inflation isn't fading away but rather gearing up for another round.

Market observers note that inflation appears to be heating up in multiple parts of the globe, yet few seem to be paying attention—a sentiment that matches what the numbers are telling us.

Inflation Rises Across Major Economies

The numbers tell a consistent story across multiple regions. Recent data shows inflation accelerating in several major economies, signaling a potential shift in the global price trend.

What looked like a steady cooldown in 2023 and early 2024 has reversed course, with multiple countries now reporting rising price pressures.

This synchronized upturn suggests these aren't isolated incidents but rather a coordinated global pattern. The data points to underlying forces that are pushing inflation higher across different economic structures and geographies.

Central banks that were preparing to ease monetary policy may need to reconsider their plans as the evidence mounts.

The reacceleration is showing up in both headline and core measures, indicating it's not just a temporary blip driven by volatile components. From Scandinavia to Asia-Pacific, the inflation picture is becoming increasingly difficult to ignore:

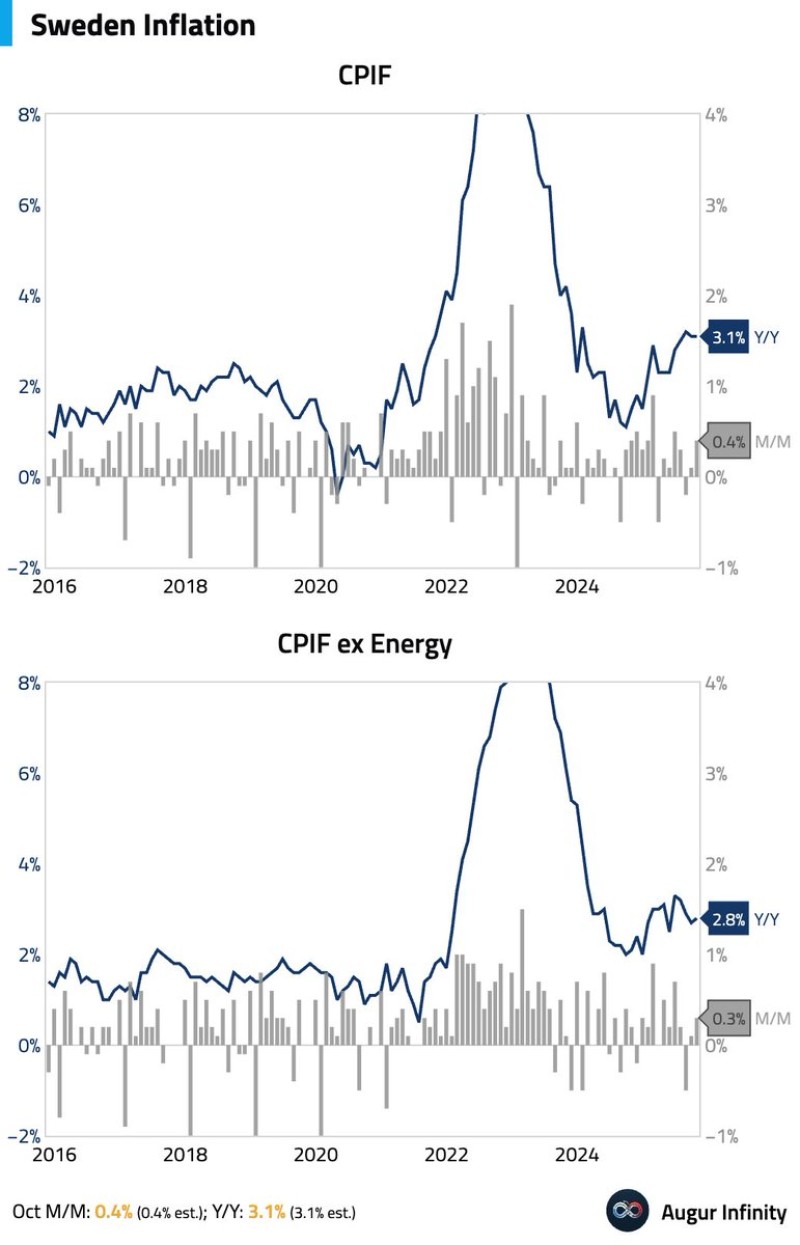

- Sweden's CPIF has climbed back to 3.1% year-over-year, up from just 0.5% earlier, with monthly inflation hitting 0.4% and matching estimates. Even when you strip out energy, core inflation sits at 2.8%, showing this isn't just about volatile fuel prices—the rise is broad-based and steady since early 2024.

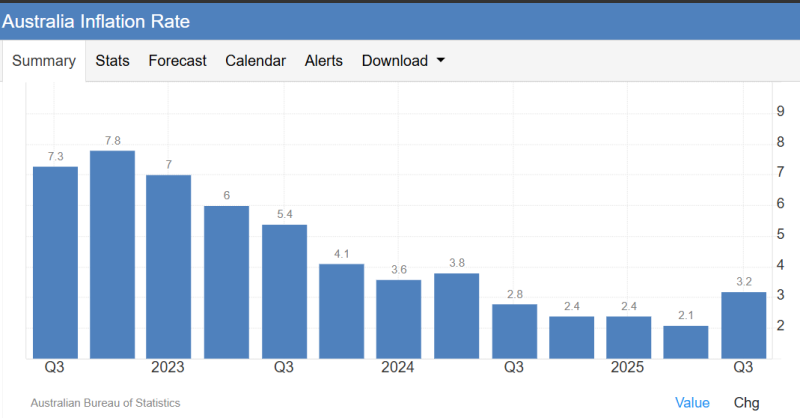

- Australia saw inflation rebound to 3.2% in Q3 2025 after gradually declining through 2023-2024 to a low of 2.1%. This reversal points to renewed demand pressures and suggests the downward trend has lost momentum.

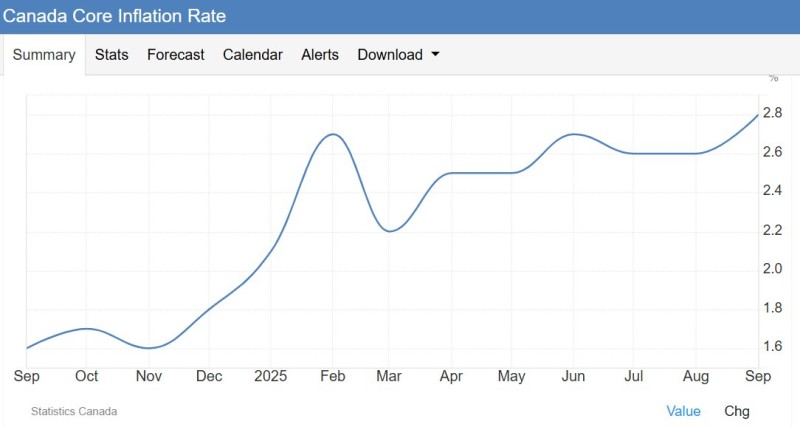

- Canada's core inflation has been steadily climbing from 2.1% to 2.8%, with a sharp spike in early 2025 followed by persistent upward movement. This stickiness hints that structural factors like wage growth, housing costs, and services pricing remain strong.

- South Korea's export price index has swung dramatically from negative territory earlier this year to 4.8% year-over-year in October, with core measures rising from 1.9% to 2.5%. This clear inflationary reversal is being driven by global demand cycles.

Why Inflation Is Heating Up Again

Several factors are coming together at once. Energy and commodity prices are rising, tight labor markets are pushing wages higher, and supply chains are still adjusting to new realities. Add to that the AI investment boom increasing demand for energy and semiconductors, plus geopolitical tensions driving up shipping and insurance costs. These aren't isolated incidents—the charts show inflation pressure building across the board.

What This Means for 2025

Here's the disconnect: global financial markets are still betting on aggressive rate cuts in 2025. But if inflation keeps climbing—even moderately—central banks could be forced to delay easing, maintain tighter policy, or in extreme cases, consider raising rates again.

If Sweden pushes past 3%, Australia stays above target, Canada's core keeps rising, or South Korea's export prices start feeding into domestic inflation, the current story of cooling prices could quickly flip to a 2025 inflation surprise.

Investors should keep a close eye on upcoming inflation data—because the global trend isn't cooling down anymore. It's warming back up.

Usman Salis

Usman Salis

Usman Salis

Usman Salis