Eurozone inflation held steady at 2.2% in September, meeting market expectations, while core inflation ticked up slightly to 2.3%. The numbers show some stability after years of volatile price swings, but they also put the European Central Bank in a tough spot when it comes to future policy moves.

A Return to Stability?

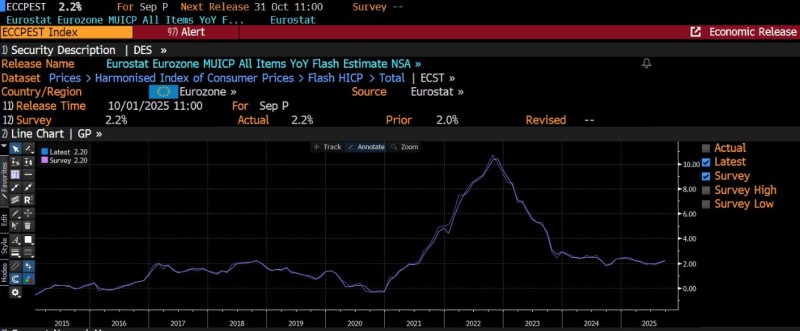

Although inflation has dropped sharply from its 2022 peak, the ECB isn't out of the woods yet. Market strategist Daniel Lacalle noted that worsening fiscal imbalances across the eurozone could push policymakers to keep easing monetary policy longer than expected to prop up growth. The Bloomberg chart illustrates how inflation, which surged past 10% during the 2022 energy crisis, has gradually settled near the ECB's 2% target. But this calm might not last.

The chart shows three key phases: inflation rocketing above 10% in 2022, a steady decline through late 2023 into 2025 bringing it back to the 2–3% range, and the latest September flash reading landing right at 2.2% year-over-year - exactly in line with forecasts.

What's Behind the Numbers?

Energy prices have normalized considerably from their 2022 shock levels, though uncertainty lingers. Meanwhile, strong wage growth keeps core inflation somewhat elevated, and rising debt burdens across member states may force the ECB to maintain looser policy for an extended period.

Usman Salis

Usman Salis

Usman Salis

Usman Salis