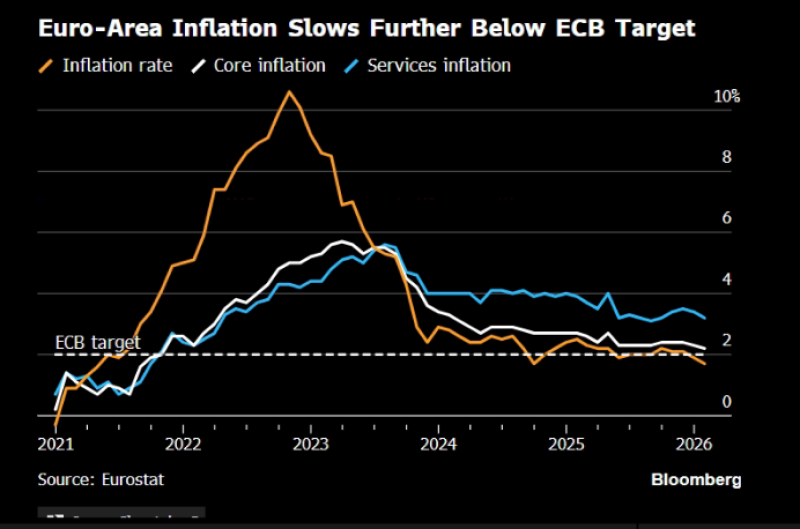

⬤ Inflation in the euro area has kept falling and recently dipped below the ECB's official target, based on the latest numbers. Headline inflation—which shot up dramatically in 2022—has been coming down steadily and now sits close to 2 percent. Core inflation and services inflation have also declined from their highs, but they're moving slower. This cooldown is starting to fuel talk about possible deflation risks across the eurozone.

⬤ The data shows headline inflation dropping faster than the deeper price pressures. Core inflation, which strips out volatile energy and food costs, peaked later and stayed above the headline number for most of this stretch—pointing to broader pricing issues throughout the economy. Services inflation has been especially sticky, easing bit by bit but still running hotter than headline inflation well into 2025 and early 2026. That gap shows just how unevenly prices are cooling across different parts of the economy.

⬤ Sure, today's inflation readings look tame, but the total price jump over the last five years is still massive. The sharp spike between 2021 and 2023 left a permanent mark on the overall cost structure across the euro area. So even though inflation has dropped below target, people and companies are dealing with significantly higher expenses than they were before the pandemic boom—something year-over-year rates don't really show.

⬤ This changing inflation picture matters because it affects how people view the economy's health and where policy might head next. Inflation falling below target raises real questions about whether growth can hold up, while the leftover damage from past price surges still shapes wages, spending habits, and how businesses set prices. As euro area inflation continues shifting, the tension between today's cooling rates and yesterday's price explosion will likely stay front and center for markets and economic forecasts.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi