On the surface, deflation—the opposite of inflation—sounds pretty good. Who wouldn't want cheaper milk and gas? Once prices begin declining consistently, economies can spiral into a dangerous feedback loop where consumers hold off on purchases, debts get heavier, and unemployment creeps up.

This pattern, known as the deflationary spiral, has historically triggered some of the most devastating economic collapses—think the Great Depression in the 1930s or Japan's "Lost Decade" in the 1990s.

The Deflationary Spiral Explained

As trader IncomeSharks recently emphasized, "Deflation scares me more than inflation," and he's not wrong.

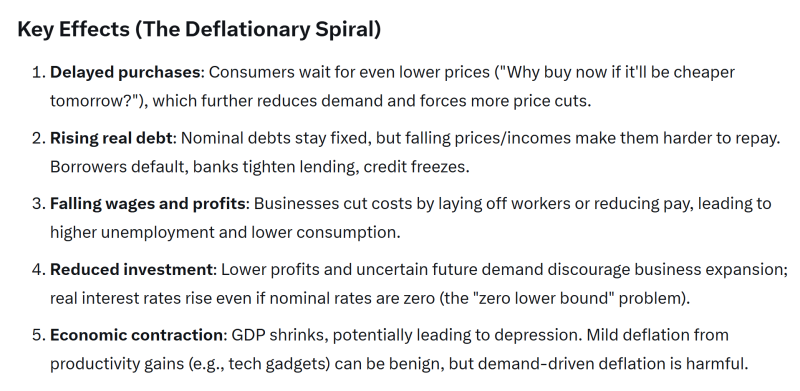

The deflationary spiral unfolds through several interconnected stages.

- Delayed Purchases. When people expect prices to keep falling, they postpone big purchases. Why buy a car today if it'll be cheaper next month? This "wait and see" mentality starves businesses of revenue, forcing them to slash prices even further—which only reinforces the problem.

- Rising Real Debt. As prices and incomes drop, the real weight of debt increases. A mortgage that seemed manageable starts feeling heavier when your salary shrinks but the monthly payment stays the same. Defaults climb, banks tighten lending, and credit dries up across the board.

- Falling Wages and Profits. Companies squeezed by lower revenues respond by cutting costs—usually starting with payrolls. Layoffs follow, unemployment rises, and the people who still have jobs earn less. This depresses spending even more, accelerating the downturn.

- Reduced Investment. Uncertainty kills ambition. Businesses stop expanding, delay new projects, and hoard cash. Even if official interest rates drop to zero, real rates—what you actually pay after accounting for deflation—stay high, making borrowing unappealing. Economists call this the zero lower bound trap.

- Economic Contraction. With spending, wages, and investment all falling, GDP stalls or shrinks. Mild deflation driven by productivity gains—say, cheaper smartphones thanks to better tech—can actually be healthy. But demand-driven deflation, where falling prices reflect weak consumer demand, is deeply toxic.

Why Deflation Is More Dangerous Than Inflation

Inflation erodes what your dollar can buy, but it usually happens alongside economic growth and job creation. Deflation does the opposite: it triggers a self-perpetuating downward loop. Consumers save instead of spend. Businesses earn less and invest even less. Banks become gun-shy about lending. Pretty soon, even strong economies can find themselves stuck in neutral or worse.

Japan's experience with deflation over multiple decades is a textbook example—near-zero interest rates and massive government spending programs still couldn't jump-start growth because weak demand kept prices and expectations suppressed.

What It Means for Investors

For financial markets, deflation is a silent killer. Corporate earnings shrink, stock prices fall, and defaults increase as debt becomes more expensive in real terms. While government bonds might look attractive initially as safe havens, prolonged deflation eventually undermines returns across nearly all asset classes.

In a deflationary environment, investors typically gravitate toward cash, defensive stocks with stable dividends, and high-quality government bonds. But even these strategies face pressure if the spiral persists long enough.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir