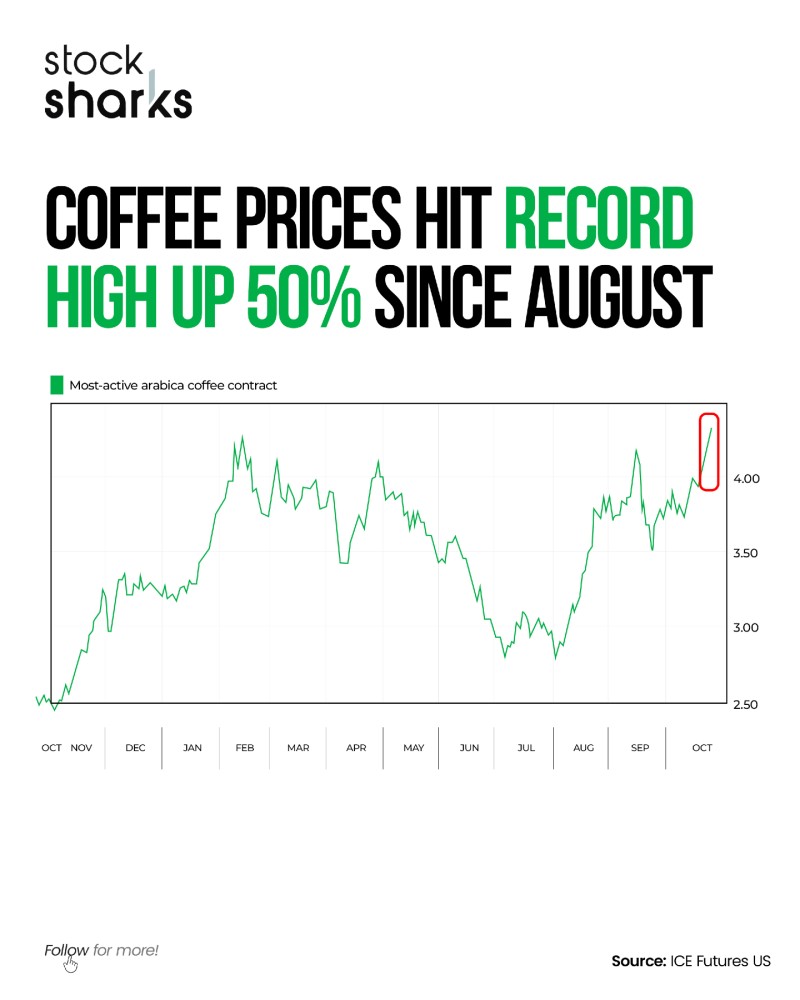

The global coffee market is experiencing unprecedented turbulence as prices reach their highest levels in years. According to ICE Futures U.S. data, the most-active arabica contract has climbed over 50% since August, hovering around $4.38 per pound. This dramatic rally stems from a combination of U.S. trade tariffs on Brazilian imports, tightening global supplies, and intensifying investor speculation.

Coffee's Parabolic Rise Signals a Brewing Crisis

The arabica futures chart reveals a striking near-vertical spike that began in late August after months of sideways movement between $3.00 and $3.50 per pound. By October, prices had broken through $4.00, pushing coffee into record territory. This represents one of the fastest market moves in over a decade.

Stock Sharks highlights that the rally reflects a powerful mix of policy-driven supply disruption and momentum-based trading. The breakout above the $3.50 resistance level that had capped prices since spring was decisively cleared in September, triggering an acceleration toward $4.38.

The steep slope of the price line suggests heavy speculative interest, likely amplified by short covering and hedge fund positioning. The only comparable spike occurred during Brazil's 2021–22 drought, highlighting how tariff policy has now overtaken weather as the primary driver of volatility.

Tariffs Trigger Supply Chain Disruption

The immediate catalyst has been the U.S. decision to impose 50% tariffs on Brazilian coffee imports—the world's largest supplier—in response to alleged export subsidies. This move effectively cut off access to a crucial low-cost source of arabica beans. With Brazil supplying nearly 40% of global arabica output, traders and roasters have scrambled to find alternatives in Colombia, Ethiopia, and Vietnam, driving their export prices sharply higher. The resulting supply shortage, combined with rising freight costs, has intensified upward price pressure across the board. Adding to the strain, climate instability in South America and East Africa has reduced yields in recent months.

Economic Impact on Consumers

The surge in coffee futures is beginning to filter through to retail markets. Major roasters and brands are expected to raise prices in coming months, adding to already elevated food inflation. While coffee-producing countries outside Brazil are seeing a windfall, importers and consumers—particularly in North America and Europe—face another inflationary blow amid persistent cost-of-living pressures.

What's Next: Sustained Volatility Expected

Analysts warn that while the rally may moderate slightly in the short term, volatility is likely to continue. With global stockpiles near multi-year lows and the U.S.–Brazil trade standoff unresolved, the risk of further price shocks remains elevated. Key price levels to watch include $3.80 as support—the prior consolidation zone—and $4.50 as the next psychological and technical resistance target. If momentum holds, traders anticipate a potential test of $4.60 per pound, which would mark a new multi-decade high.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah