A quiet but monumental shift is reshaping the global economy. While markets focus on quarterly earnings and rate cuts, something bigger is happening beneath the surface. A recent analysis reveals a stunning projection: China is expected to control nearly half of global industrial production by 2030. This isn't just growth—it's a complete rewriting of who makes what in the world.

China's Industrial Expansion Marks a Turning Point in Global Manufacturing

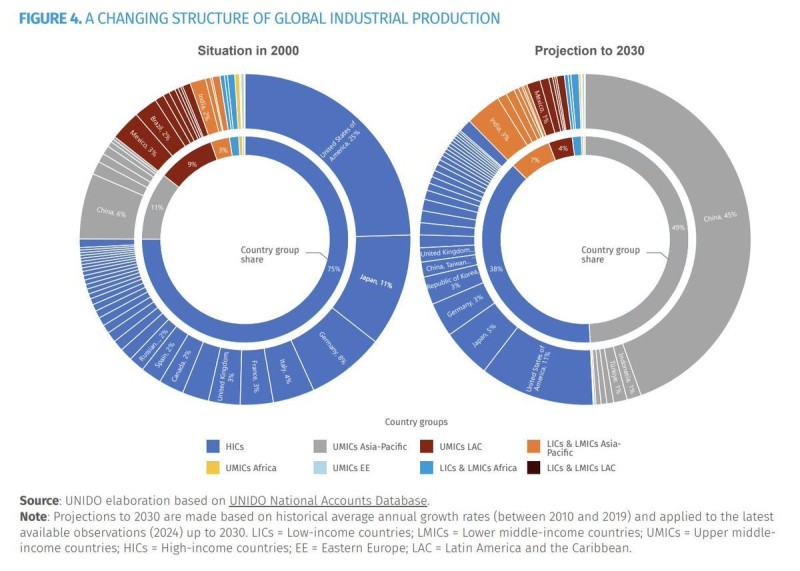

The numbers highlighted by analyst Jostein Hauge tell an incredible story. Back in 2000, China accounted for just 6% of global manufacturing output. By 2030, projections show that hitting 45%—almost half of everything made on the planet coming from one country. No industrialization in history has happened this fast or on this scale.

Meanwhile, high-income economies are losing ground fast. In 2000, wealthy nations like the U.S., Japan, Germany, and the U.K. held 75% of global manufacturing. By 2030, that's expected to drop to just 38%. Other parts of Asia are growing too—Taiwan, South Korea, Thailand, and Malaysia are expanding their roles in advanced supply chains. India is climbing from 2% to 7%, solid growth but still dwarfed by China's surge. Latin America and Africa remain on the sidelines, with their manufacturing shares barely moving.

The entire structure of global production is rotating from a Western-centered system to an Asia-centric machine anchored by China.

Why China's Industrial Rise Happened—And Why It Continues

China didn't stumble into this position. The country built infrastructure at a scale no one else could match—ports, rail networks, energy grids, and supply chains that work like clockwork. Hundreds of millions of workers shifted from low-value jobs to advanced manufacturing roles, creating a workforce that's both massive and increasingly skilled.

Government strategy played a huge role. Long-term plans like Made in China 2025 funneled capital into strategic industries with laser focus. Foreign companies poured investment in, using China as a manufacturing base for global markets. Now, as Chinese incomes rise, the country produces for its own enormous consumer base too, adding another layer of momentum.

The combination of scale, infrastructure, planning, and market size created something extremely hard to replicate. Even with all the talk about nearshoring, China's industrial density remains unmatched.

What This Means for Investors, Policymakers, and Global Markets

This shift has real consequences. Global supply chains will keep reorienting around Asia, and despite efforts to diversify, China's role isn't going anywhere soon. That means geopolitical and trade tensions will keep rising—export controls, tariffs, and economic security policies are becoming permanent features of the West-China relationship.

For multinational corporations, the playbook is getting complex. Companies need dual strategies: one for China's ecosystem and another for building alternatives in Vietnam, India, Indonesia, and Malaysia. Those emerging economies stand to benefit as firms spread risk, but none can fully replace what China offers.

Investors need to pay attention. The next decade won't just be shaped by AI hype or rate moves—it'll be defined by China sitting at the center of global production.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov