China's economy is sending mixed signals as inflation continues to disappoint. The latest data shows consumer prices barely rising, while money printing has slowed to levels that make hitting official targets nearly impossible. For traders and investors watching the world's second-largest economy, these numbers raise serious questions about demand, growth, and what Beijing might do next.

Inflation Falls Far Short of 2% Policy Goal

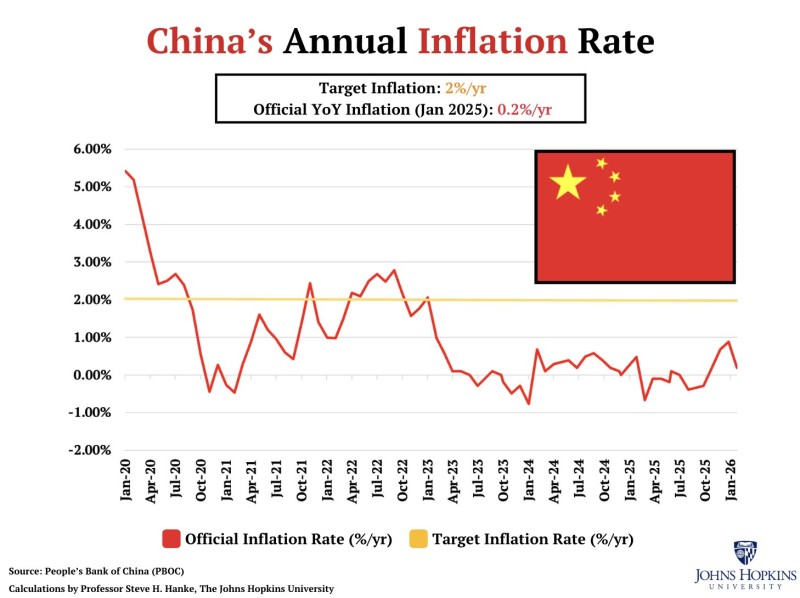

China's annual inflation rate came in at just 0.2% year over year in January, according to data highlighted by Steve Hanke. That's a tenth of the official 2% target the government has set as its inflation objective.

Looking at the trend, inflation has been running below target for most of the period since 2023, with repeated dips toward zero. The chart tracking China's annual inflation rate shows prices spiking above 5% in early 2020, then crashing through 2020–2021. There was a brief run above 2% during parts of 2022, but since then it's been sliding back toward low single digits and near-zero readings.

Money Supply Growth Signals Deeper Problems

The weak inflation numbers aren't happening in a vacuum. China's M2 money supply is expanding at roughly 8.5% annually—below the 10% pace economists say is needed to generate 2% inflation. This slower monetary growth has coincided with deflation pressure and soft consumer prices, as covered in broader analysis of China's money supply growth slows.

There have even been periods where consumer prices moved into outright negative territory. Earlier coverage detailed how China CPI falls to -0.4%, marking a clear deflation episode that spooked markets and policymakers alike.

What It Means for Markets and Policy

When inflation consistently undershoots targets, it affects everything from currency expectations to real interest rates and cross-border capital flows. If prices stay subdued while money printing remains below target levels, the policy debate will keep circling back to liquidity conditions and demand recovery.

China's growth momentum has also been slowing, with GDP expansion dropping to 4.8% as tracked in China's GDP growth slows to 4.8%. Inflation and growth trends often move together, and right now both are pointing in the wrong direction for Beijing's comfort.

The question now is whether authorities will step up stimulus efforts or accept a prolonged period of low inflation and modest growth.

Usman Salis

Usman Salis

Usman Salis

Usman Salis