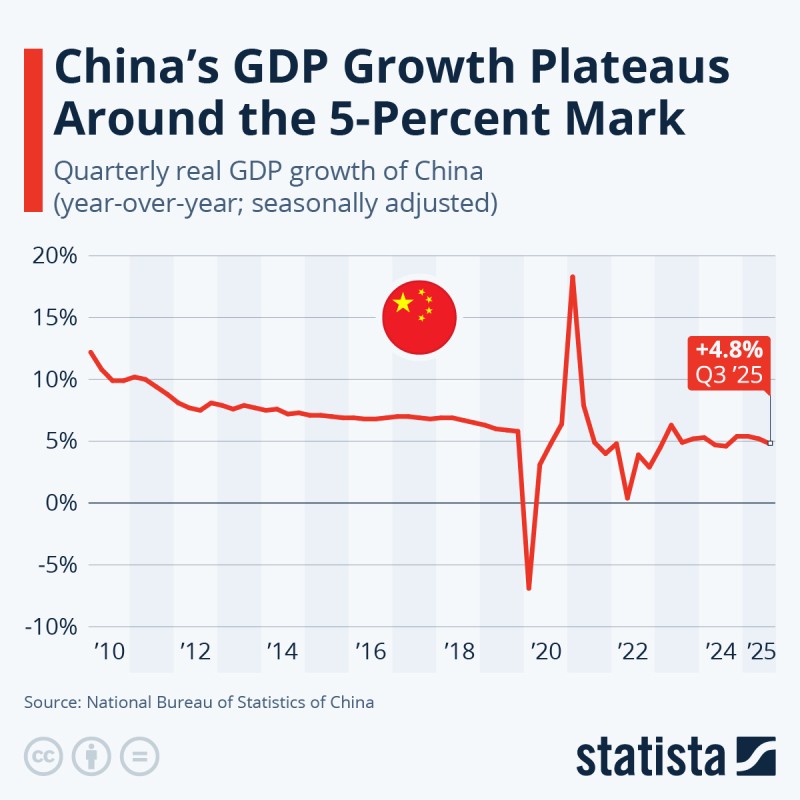

China's economic growth slowed to 4.8% year-over-year in the third quarter of 2025, down from 5.4% in Q1 and 5.2% in Q2, according to the National Bureau of Statistics. The deceleration shows the world's second-largest economy is facing headwinds from sluggish consumer spending, export weakness, and continued real estate troubles. The accompanying Statista chart reveals China's real quarterly GDP growth stabilizing near the 5% threshold, a far cry from the double-digit surges of the 2010s, underscoring the country's shift from rapid industrial expansion to a more moderate pace.

Growth Settles Around 5 Percent

According to Stock Sharks analyst observations, China's growth plateau reflects a decade-long transition from explosive expansion to a more balanced trajectory as Beijing prioritizes innovation and domestic consumption over raw scale.

The Q3 reading of 4.8% fits this pattern—steady but subdued compared to the post-pandemic rebounds of 2020–2021. While the figure keeps China's "around 5%" annual target within reach, sustaining even this modest pace requires ongoing policy support amid fragile consumer confidence, declining housing investment, and soft export orders.

Main Pressures Weighing on the Economy

Multiple structural and cyclical factors continue dragging on growth. The property sector remains troubled, with developers carrying heavy debt loads and home sales still below pre-crisis levels. External demand has weakened as Western economies slow and trade tensions persist, reducing export volumes. Household spending stays cautious despite targeted stimulus, as workers worry about job security and stagnant wages. Meanwhile, local governments face limited capacity to fund infrastructure projects due to their own debt burdens. Economists note these challenges are pushing policymakers to lean more heavily on industrial modernization, AI manufacturing, and green energy investment to drive future productivity.

Policy Response and Global Implications

The People's Bank of China is expected to maintain its pro-growth stance, potentially cutting reserve requirements or expanding liquidity to support lending. Fiscal policy will likely target technology upgrades and clean-energy infrastructure, sectors viewed as central to China's next growth phase. For global markets, a slower but stable China presents mixed outcomes:

- It eases worldwide inflationary pressure by reducing demand for raw materials, but also dampens global trade flows and commodity prices, particularly affecting exporters in Asia, Latin America, and Africa.

Toward Sustainable Expansion

China's latest GDP figures confirm what many analysts call a "new normal"—an era defined by moderation rather than acceleration. The days of double-digit expansion have ended, replaced by a more sustainable path focused on stability, innovation, and domestic resilience. With Q3 2025 growth at 4.8%, China stays on track for its annual goal, but the message is unmistakable: the country's next economic chapter will prioritize quality over quantity.

Peter Smith

Peter Smith

Peter Smith

Peter Smith