While most countries have experienced food inflation significantly outpacing general price growth since 2019, China has maintained steady GDP expansion with virtually no inflationary pressure. This striking contrast is reshaping how economists view global economic stability.

Purchasing Power Gains in China

China's economy continues growing at roughly 5% annually while consumer prices remain remarkably stable. Analyst Orikron recently highlighted this phenomenon, pointing out a key difference in how China measures economic progress.

Unlike many nations that track total income, the Chinese government focuses on per capita disposable income - the money households actually have left after covering essential expenses. This approach ensures that improvements in purchasing power are both visible and meaningful to ordinary citizens.

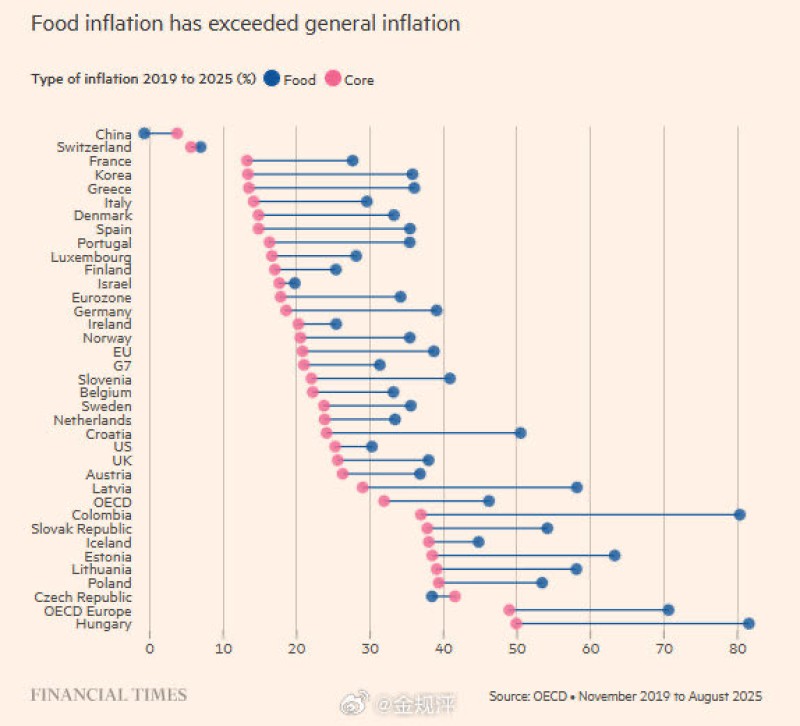

Chart Analysis: Food vs. Core Inflation Worldwide

Recent data from the OECD and Financial Times reveals dramatic inflation trends from 2019 to 2025. China shows near-zero food and core inflation, creating a stark contrast with its global peers. In Europe and the United States, countries like Hungary, Poland, and the Czech Republic have seen food inflation levels exceeding 60–70%, far surpassing their core inflation rates.

Even in developed economies across the Eurozone and G7 nations, food inflation has consistently outpaced general inflation, steadily eroding real wages and squeezing household budgets. This data reinforces a critical observation: while consumers worldwide face shrinking disposable incomes, Chinese households benefit from an unusual combination of economic growth and price stability.

Why China Is Different

Several deliberate policy choices explain China's economic divergence:

- State-managed food reserves and pricing mechanisms reduce exposure to global supply shocks

- Strong domestic production capabilities lessen dependency on volatile import markets

- A focus on disposable income rather than headline income ensures households experience tangible improvements in their daily lives

Implications for Investors

The stability of consumer prices combined with rising incomes suggests China's domestic market may continue supporting robust consumption growth. Compared to inflation-pressured Western economies, China offers investors a more predictable environment, particularly in retail, consumer staples, and consumption-driven sectors. This relative stability makes Chinese markets increasingly attractive for those seeking to avoid the volatility plaguing other major economies.

Peter Smith

Peter Smith

Peter Smith

Peter Smith