Switzerland's price stability continues to hold firm as the country's inflation rate barely moves above zero. With M3 money supply growth positioned near the lower boundary of its optimal range, the Swiss National Bank's monetary framework appears to be delivering exactly what economists expected—a stable, low-inflation environment that mirrors controlled liquidity conditions.

Switzerland's Inflation Sits at Historic Lows

The country's annual inflation rate currently stands at just 0.03%, placing it firmly at the bottom of the central bank's comfort zone. According to economist Steve Hanke, this outcome isn't random—it directly reflects how Switzerland manages its money supply.

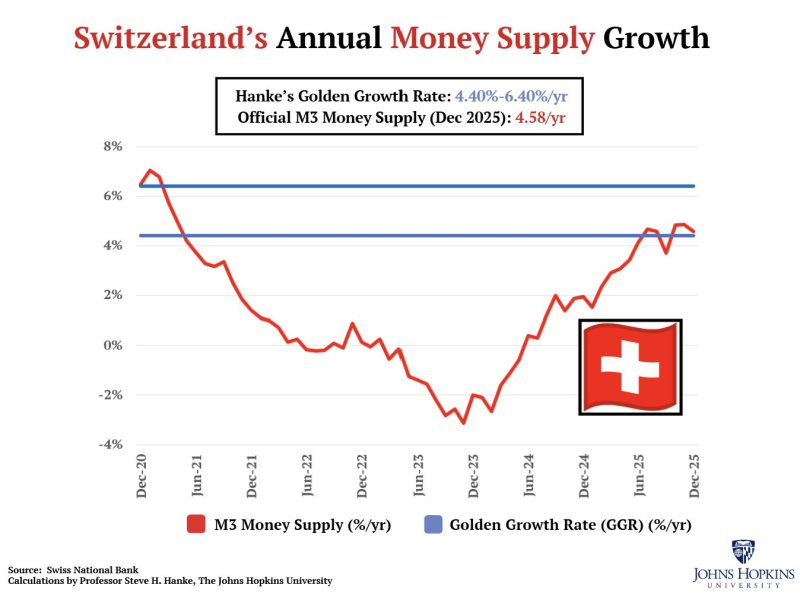

December 2025 figures show M3 money supply growth reached 4.58% year-over-year. That number sits just inside the Golden Growth Rate band, which runs from 4.40% to 6.40% annually. The GGR framework, developed by Hanke at Johns Hopkins University, offers a benchmark for assessing whether monetary expansion aligns with stable price outcomes.

M3 Recovery After Years Below Target

Switzerland's monetary journey over recent years hasn't been smooth. The chart accompanying Hanke's analysis reveals that M3 growth spent considerable time below the GGR corridor following 2020. The money supply even dipped into negative territory during 2023 before recovering toward the benchmark range.

Switzerland's M3 money supply growth was 4.58% per year in December 2025, compared with a Golden Growth Rate range of 4.40% to 6.40%, Hanke noted in his recent report.

This gradual return to the optimal zone coincides with inflation settling near zero, supporting the monetary theory that price movements track liquidity conditions over time.

What This Means for CHF and Price Stability

With M3 expansion now hovering near the lower end of the Golden Growth Rate, Switzerland appears positioned to maintain its low-inflation trajectory. The Swiss National Bank's data, analyzed through Hanke's framework, suggests the current monetary setup favors continued price stability.

Other major economies face different monetary challenges. US money supply growth recently fell below its Golden Rate benchmark, while China's slowing M3 expansion has raised deflation worries among analysts.

Outlook for Swiss Monetary Policy

If CHF liquidity growth remains restrained within the GGR band, Switzerland's near-zero inflation environment should persist. The alignment between M3 trends and price outcomes reinforces the view that controlled money supply expansion delivers predictable inflation results.

Switzerland's current position—with inflation at 0.03% and M3 growth at 4.58%—demonstrates how monetary discipline can anchor price stability even as global economic conditions shift.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah