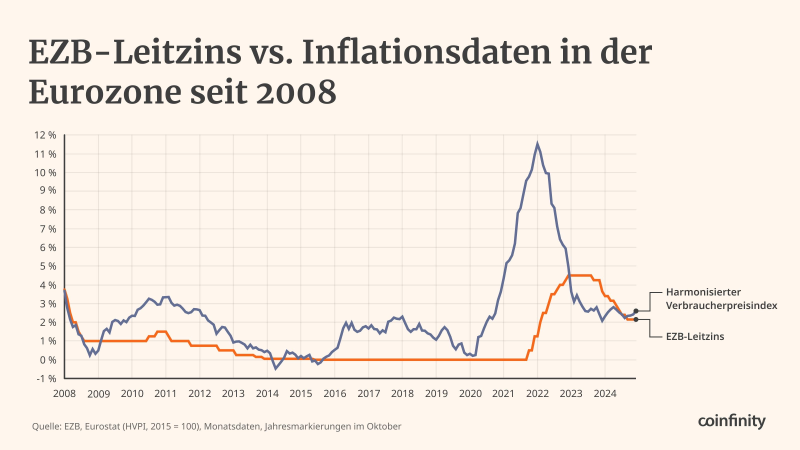

● Sixteen years after Bitcoin's whitepaper, the economic problems it was designed to solve are still here. Since the 2008 crisis, Eurozone inflation has consistently beaten the European Central Bank's key rate, leaving savers stuck in an era of negative real interest rates. While low rates helped borrowers and investors, they quietly destroyed the value of savings.

● When inflation hit 10% in 2022 while the ECB's rate sat around 4%, the gap was brutal for savers. The ECB eventually raised rates, but inflation remains stubborn, and real yields are still negative. Critics say the central bank moved too slowly and created years of inequality and asset bubbles. But raising rates too fast could trigger another recession—a tough spot for policymakers.

● This is exactly why Bitcoin emerged in 2008. Released during the financial crisis, the Bitcoin whitepaper offered a decentralized alternative—no central bank, no currency debasement, no political interference. With a hard cap of 21 million coins, it stands in stark contrast to the ECB's decade of negative real rates.

● As Fab summed it up: "Since the financial crisis, inflation has mostly been higher than the key rate. Real interest rates? Negative for years. Bitcoin was created as an answer to this system." With the Eurozone still squeezing savers and inflation hanging on, Bitcoin's original message hits harder than ever: in today's monetary system, having a choice matters.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi