BTC Braces for Impact as China's Trade Data Surprises Markets

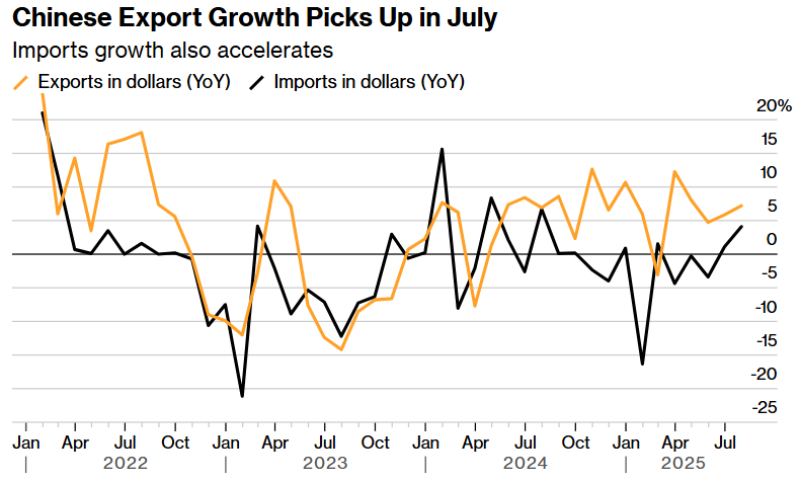

China just dropped some pretty impressive trade numbers, and Bitcoin traders are paying close attention. The country's export growth picked up serious steam in July, while imports also accelerated - a combo that's got the crypto world buzzing about what comes next.

Here's the thing: when China's economy starts flexing like this, it usually means big moves are coming for risk assets like Bitcoin. The stronger trade figures suggest China's economic engine is firing on all cylinders, which traditionally gets global markets excited. But there's a catch - it also makes everyone wonder if policy makers might start tightening things up.

What's really got everyone on edge is Friday's massive data dump from China. We're talking industrial production, retail sales, fixed asset investment, and unemployment figures all dropping at once. That's a lot of economic firepower that could send BTC in either direction.

Bitcoin (BTC) Traders Watch Asian Economic Tsunami Approaching

Friday isn't just about China though. Japan's about to release their Q2 GDP numbers, and early whispers suggest they managed to dodge a recession bullet. If that plays out, it could add serious fuel to the risk-on fire that typically lifts Bitcoin higher.

But wait, there's more. Singapore, Malaysia, Taiwan, and Hong Kong are all dropping their GDP figures too. That's basically the entire Asian economic powerhouse reporting in at once. For Bitcoin, this could be the perfect storm of positive data that pushes prices into new territory.

BTC Price Prediction Hinges on This Week's Data Avalanche

The big question everyone's asking: will all this good economic news actually help Bitcoin, or will it backfire? Strong data usually means happy markets, but it also raises the specter of tighter monetary policy down the road.

For BTC specifically, we're looking at a classic risk-on scenario. If these Asian economies keep showing strength, institutional money tends to flow into alternative assets like crypto. But seasoned traders know that good news can sometimes be bad news if it means less liquidity in the system.

Peter Smith

Peter Smith

Peter Smith

Peter Smith