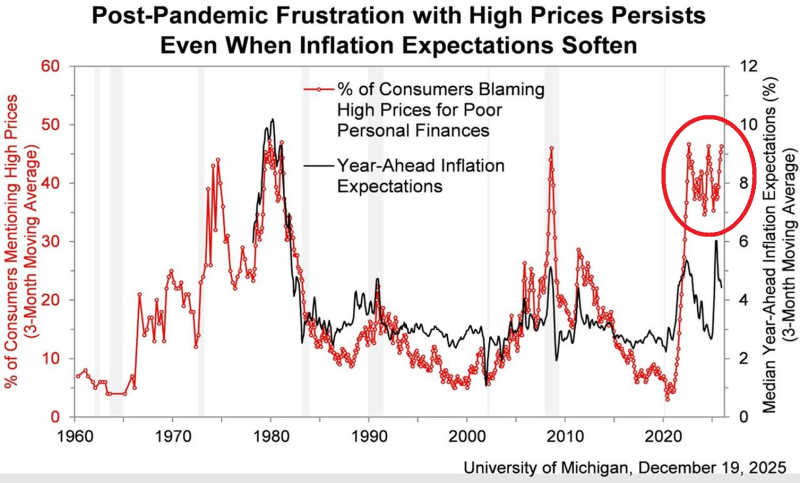

⬤ Fresh data from the University of Michigan reveals something striking: Americans are still furious about high prices, even though they think inflation will ease up soon. Right now, about 45 percent of consumers say high prices are wrecking their personal finances. That's nearly as bad as it got during the Great Financial Crisis and the brutal inflation years of the late 1970s and early 1980s.

⬤ The numbers tell an interesting story. One measure tracks how many people blame high prices for their money troubles, and it's been sky-high since the pandemic. But here's the twist: people's expectations for future inflation have actually come down from recent peaks. So Americans think prices will stop rising as fast, but they're still incredibly frustrated with what things cost right now.

⬤ Looking back makes today's situation even more unusual. Back in 2020, only about 5 percent of consumers pointed fingers at high prices for their financial problems. Now it's nearly nine times higher. The real issue isn't where inflation is going—it's the damage already done by years of price increases that people are still trying to absorb.

⬤ Because how people feel about prices shapes how they spend money and view the economy. Even if inflation keeps cooling off, persistent anger about expensive groceries, gas, and rent can hold back consumer spending. People care more about whether they can actually afford things than whether prices are rising slower than before. Until everyday costs feel manageable again, Americans will likely stay frustrated, and that has real consequences for economic growth and policy decisions.

Peter Smith

Peter Smith

Peter Smith

Peter Smith