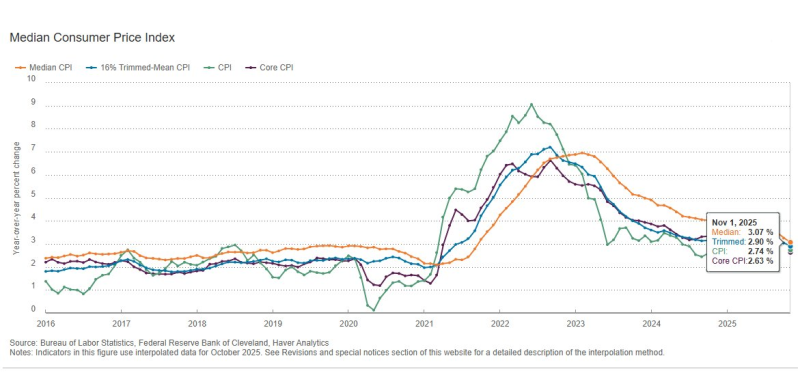

⬤ US inflation kept cooling in November, with several key measures that ignore extreme price movements falling to their lowest levels since 2021. Cleveland Fed data reveals that median CPI, trimmed-mean CPI, and core CPI all hit multi-year lows. The numbers show a widespread slowdown in price increases, confirming that inflation has backed off significantly from its post-pandemic highs.

⬤ The data paints an encouraging picture: median CPI dropped to 3.07% year-over-year in November—the lowest it's been since September 2021. The 16% trimmed-mean CPI fell to 2.90%, matching levels last seen in May 2021. Core CPI, which strips out volatile food and energy costs, came in at 2.63%—the weakest reading since March 2021. These indicators are specifically designed to cut through the noise and show what's really happening with persistent inflation trends.

These measures are designed to provide a clearer picture of persistent inflation trends by reducing the influence of short-term volatility.

⬤ Looking at the bigger picture, inflation spiked hard during 2021 and 2022 before starting a steady decline through 2023 and 2024 into this year. While headline CPI bounced around more dramatically, the median and trimmed-mean measures show a much smoother downward trend. The fact that they're all moving together toward pre-surge levels suggests inflation is easing across the board—not just in a few categories.

⬤ For financial markets, this matters a lot. Policymakers and investors pay close attention to these outlier-adjusted inflation metrics when they're trying to gauge underlying price stability. When median CPI and trimmed-mean CPI keep falling like this, it shapes expectations about where interest rates might be headed and what the Fed might do next. Now that these measures are approaching levels we haven't seen since before the inflation surge began, the big question is whether this cooling trend will stick around.

Peter Smith

Peter Smith

Peter Smith

Peter Smith