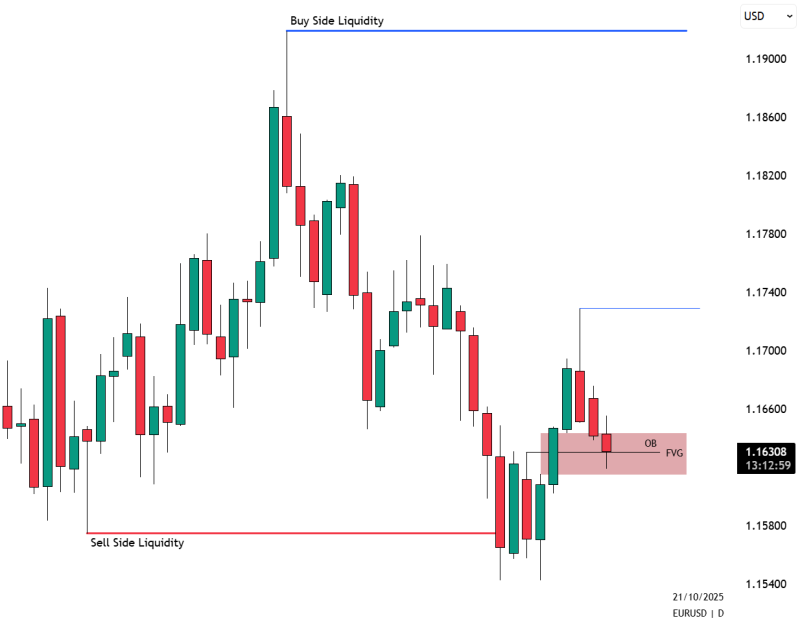

The EUR/USD pair is trading near 1.1630, right at the intersection of a Fair Value Gap (FVG) and Order Block (OB) — a technical zone that could determine whether the currency pair pushes higher or faces downside pressure in the coming sessions.

Technical Setup: Fair Value Gap as Market Pivot

Trader SIRRILLAH recently pointed out that the daily FVG zone is the main level worth watching for EUR/USD's next directional move.

The chart shows the pair stuck in a tight range between 1.1580 and 1.1660, with buy side liquidity marked near 1.1900 and sell side liquidity around 1.1540. This positioning suggests the market is building energy before making a more significant move in either direction.

Price Action and Key Levels

After testing the 1.17 level, the euro pulled back into the OB–FVG confluence area. This type of structure typically acts as a zone where smart money looks for discounted entries within an ongoing bullish trend. The overlap of these two technical features creates what many traders consider a high-probability support area, especially when broader market structure remains intact.

Support and Resistance Outlook

From a technical standpoint, this demand zone has previously absorbed selling pressure. Holding above 1.1620 would keep bullish momentum alive, potentially opening the door toward 1.1740–1.1780, with 1.19 as the next major target aligned with buy side liquidity. However, losing this FVG support could trigger downside movement toward 1.1580 and eventually 1.1540, matching the sell side liquidity zone marked on the chart.

Macro Context and Market Drivers

The EUR/USD's near-term path remains closely tied to U.S. dollar strength and shifting rate expectations. Recent changes in Federal Reserve messaging combined with softer eurozone economic data have created mixed momentum for the pair, which is why this particular price zone carries added technical weight right now.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov