EURUSD just can't catch a break. After tumbling from 1.1819 all the way down to test 1.1720 support, the pair is now limping around the 1.1745-1.1760 range trying to find its footing.

What the Charts Are Telling Us

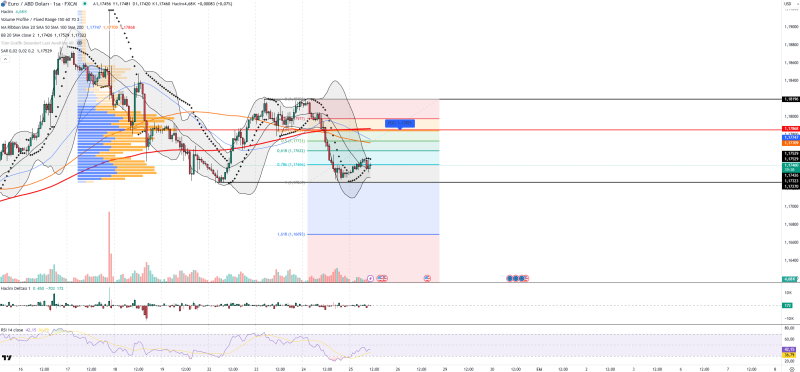

A recent chart from Forex Sinyal Merkezi shows the euro attempting to stabilize, but the technical picture is still messy and the dollar isn't giving much ground.

The euro faces a wall of resistance that starts at 1.1762 (that's the 0.618 Fib level), then moves up to 1.1773 where the 50-day moving average sits, and finally hits 1.1788. Break through all that, and suddenly 1.1819 is back in play. But if buyers can't get it done, we're looking at support at 1.1746 first, then the more serious floor around 1.1723-1.1720. Lose that, and the Fibonacci target at 1.1693 comes into focus fast.

The momentum indicators paint an interesting picture. RSI at 42.15 shows the euro is beaten up but not completely dead - there's room for a bounce. Volume Delta at +172 suggests some buyers are stepping in, even though sellers have been running the show. Bollinger Bands show price hugging the lower band, which often sets up rebounds. But here's the kicker - Parabolic SAR is still sitting below 1.1729, confirming the downtrend isn't over yet.

The Bigger Picture

The dollar index keeps flexing its muscles ahead of key U.S. data releases, and that's making life tough for the euro. The European Central Bank's cautious approach to rates isn't helping either - they're basically giving traders no reason to get excited about the euro right now. This week's U.S. macro data could be the catalyst that decides which way this pair breaks.

- Resistance Zone: 1.1762-1.1788 - Break above here and the euro might have something

- Support Floor: 1.1720-1.1723 - Lose this and things get ugly fast

- Bounce Target: 1.1819 - The recent high if bulls can gain control

- Breakdown Target: 1.1693 - Where bears are aiming if support fails

EUR/USD is stuck in trading purgatory right now. If it can muscle above 1.1773 and hold, we might see some upside momentum toward 1.1788 and beyond. But if 1.1720 gives way, the path to 1.1690 opens up quick. Either way, the dollar's strength is the story here, and until that changes, the euro's recovery looks fragile at best.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah